What Accountancy & Finance Professionals Are Really Looking for in a Job in 2025 Report

03 Mar, 20251-2 minutes

Introduction

The accountancy and finance job market is undergoing significant transformation, driven by technological advancements, shifting workforce dynamics, and evolving professional priorities.

As accountancy practices and businesses compete to attract, engage and retain top talent, understanding the motivations and preferences of jobseekers has never been more critical. Our report delves into what accounting and finance professionals are looking for in their roles today, and what key drivers would make them jump ship and join another practice.

Throughout our report, you will see an in-depth analysis of the results including what professionals are looking for in a job in terms of preferred salary, perks, benefits, company culture and how to accommodate those needs to recruit, engage and retain the best talent.

Our report includes the opinions and thoughts of those actively searching for a job in 2025 and those who aren’t. Both offer invaluable insights into the landscape of what employees really want from their job and career in 2025.

Employers can utilise our report to understand the current needs and motivations of professionals and shape their employee value proposition accordingly to cater to the individual needs of the employee.

Key findings

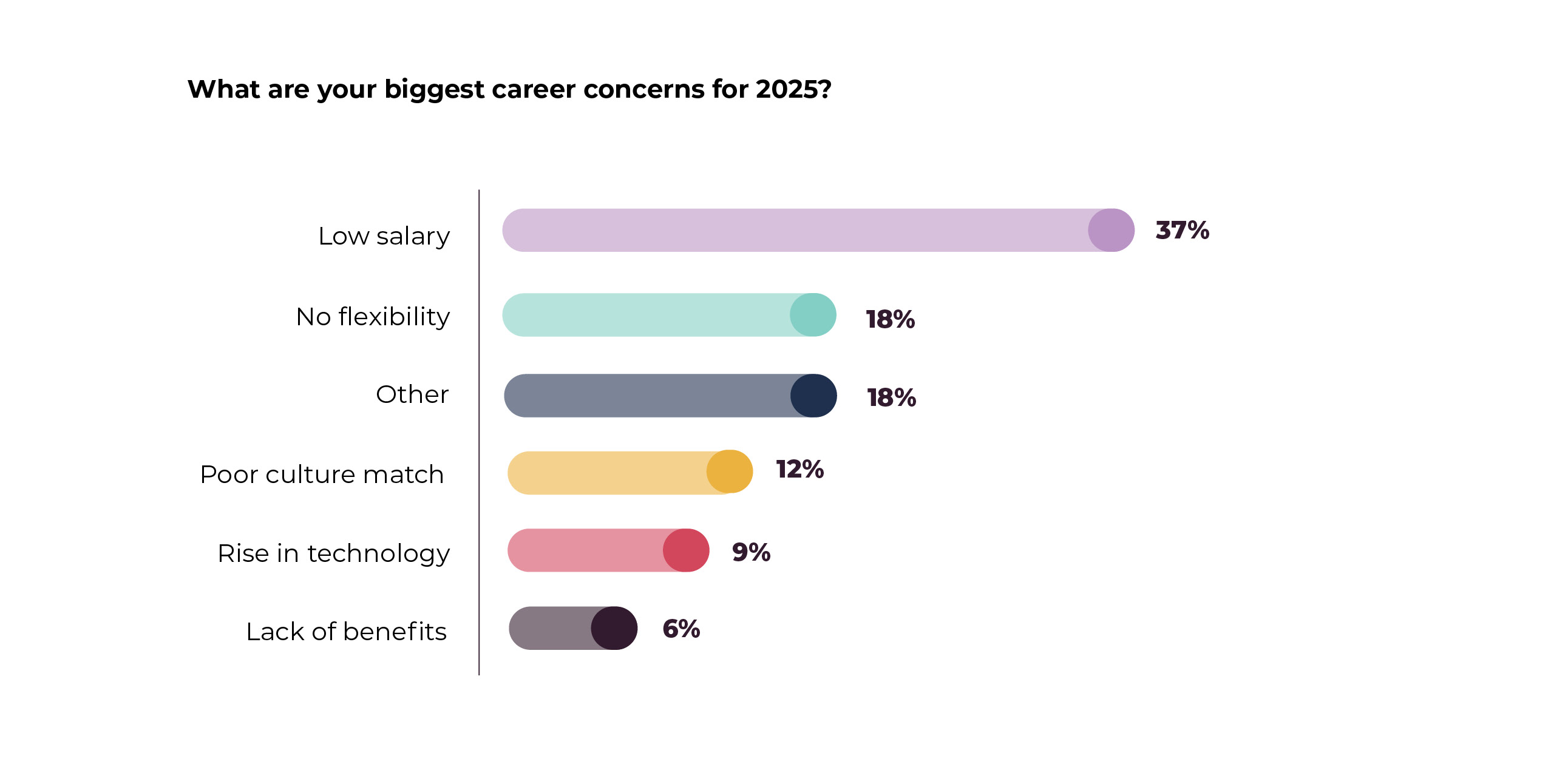

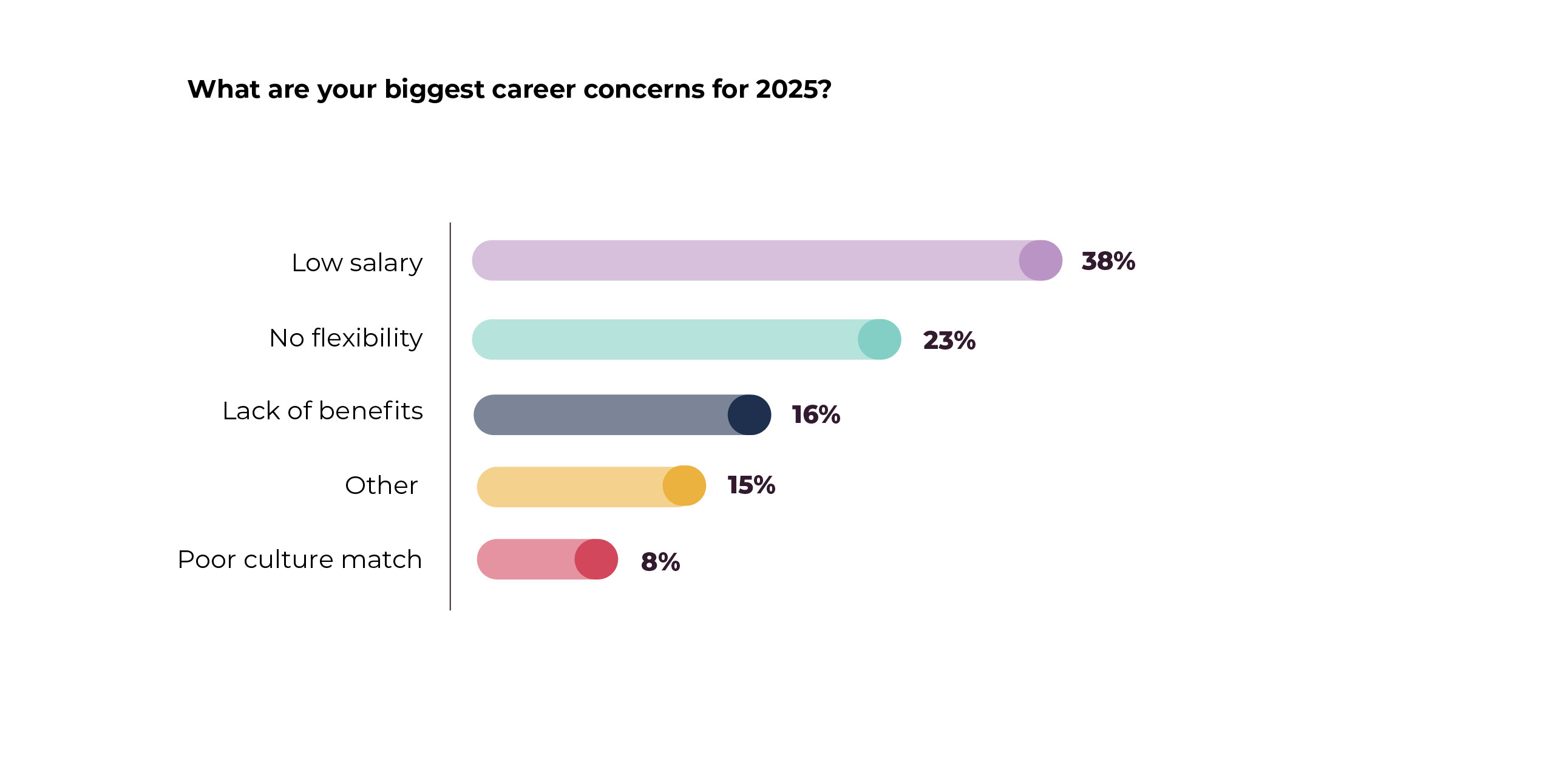

- 38.3% of professionals identified low salary as their primary career concern in 2025.

- 36.7% of professionals cited a higher salary as their main reason for looking for a new job.

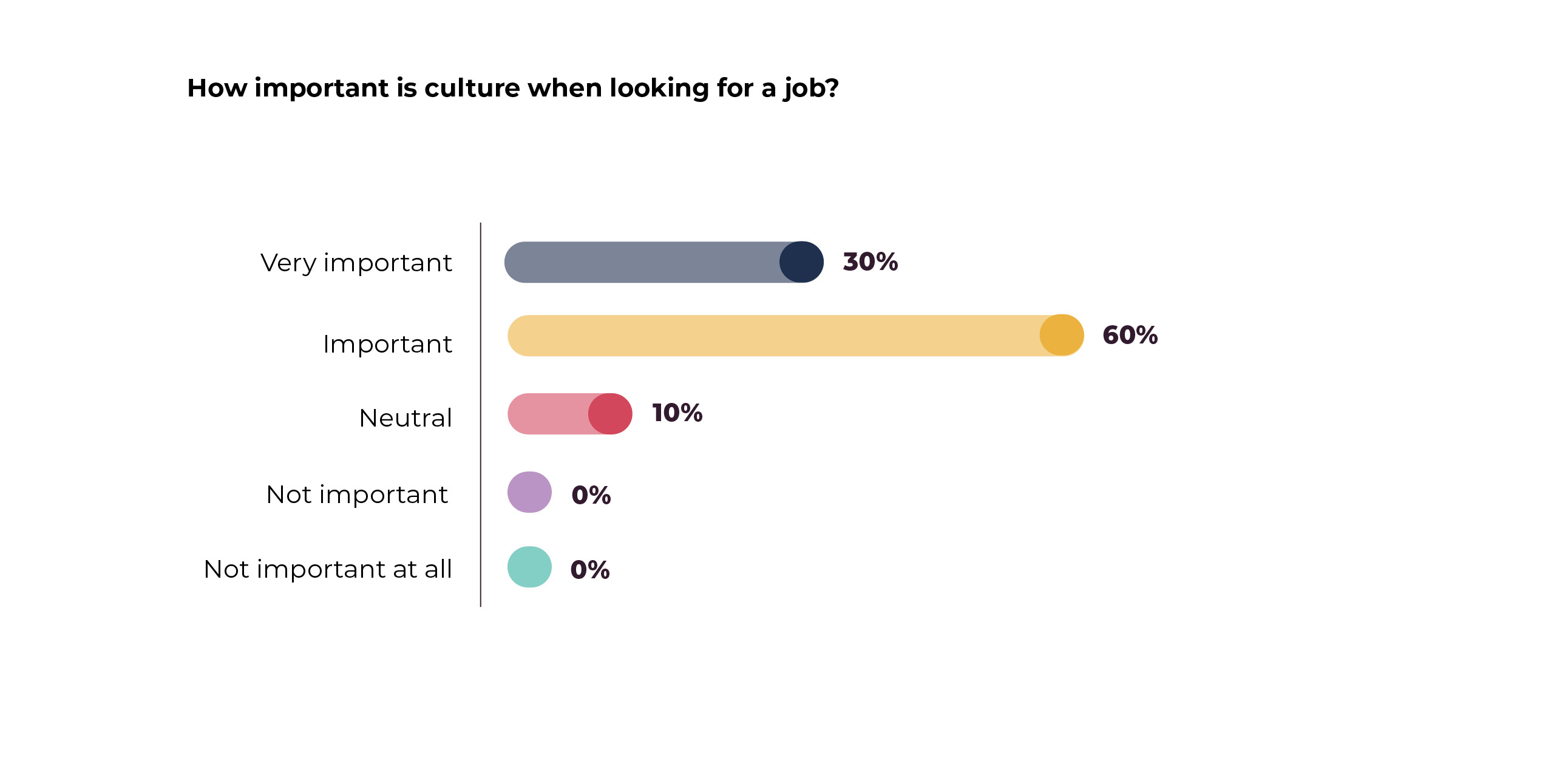

- 90% of professionals believe culture was ‘important’ or ‘very important’ when looking for a new job in 2025.

- 50% of professionals believe their current salary and benefits don’t reflect their actual value.

- 56.7% of professionals wouldn’t accept a lower salary in exchange for improved work-life balance.

- Irrespective of age, gender or seniority, a high salary is a key priority and driver for accountancy and finance professionals.

- Female professionals are primarily concerned with low salaries and a lack of work flexibility.

- Female professionals are actively seeking competitive salaries that reflect their worth, provide opportunities for growth and skills development, and offer greater flexibility.

- Despite the rapid advancement of technology and the increasing use of AI, only 10% of professionals expressed concern about the rise in technology.

Public and private sector recruitment trends

In 2024, organisations across the public and private sector placed a strong emphasis on supporting employee wellbeing and CPD opportunities to accelerate career growth. Accountancy practices and businesses that adapted to these trends were able to maintain a competitive edge in recruiting and retaining top talent. Moving into 2025, our report highlights how professionals are seeking well paid and meaningful roles which prioritise work-life balance and flexible working options.

Public sector recruitment trends

Our report found that 36% of public sector professionals are seeking a new job in 2025. 47% cite looking for a role with a higher salary as the leading reason, with annual salary increment being the most desirable perk (47%), followed by flexi time (16%) and a four day working week (10.5%).

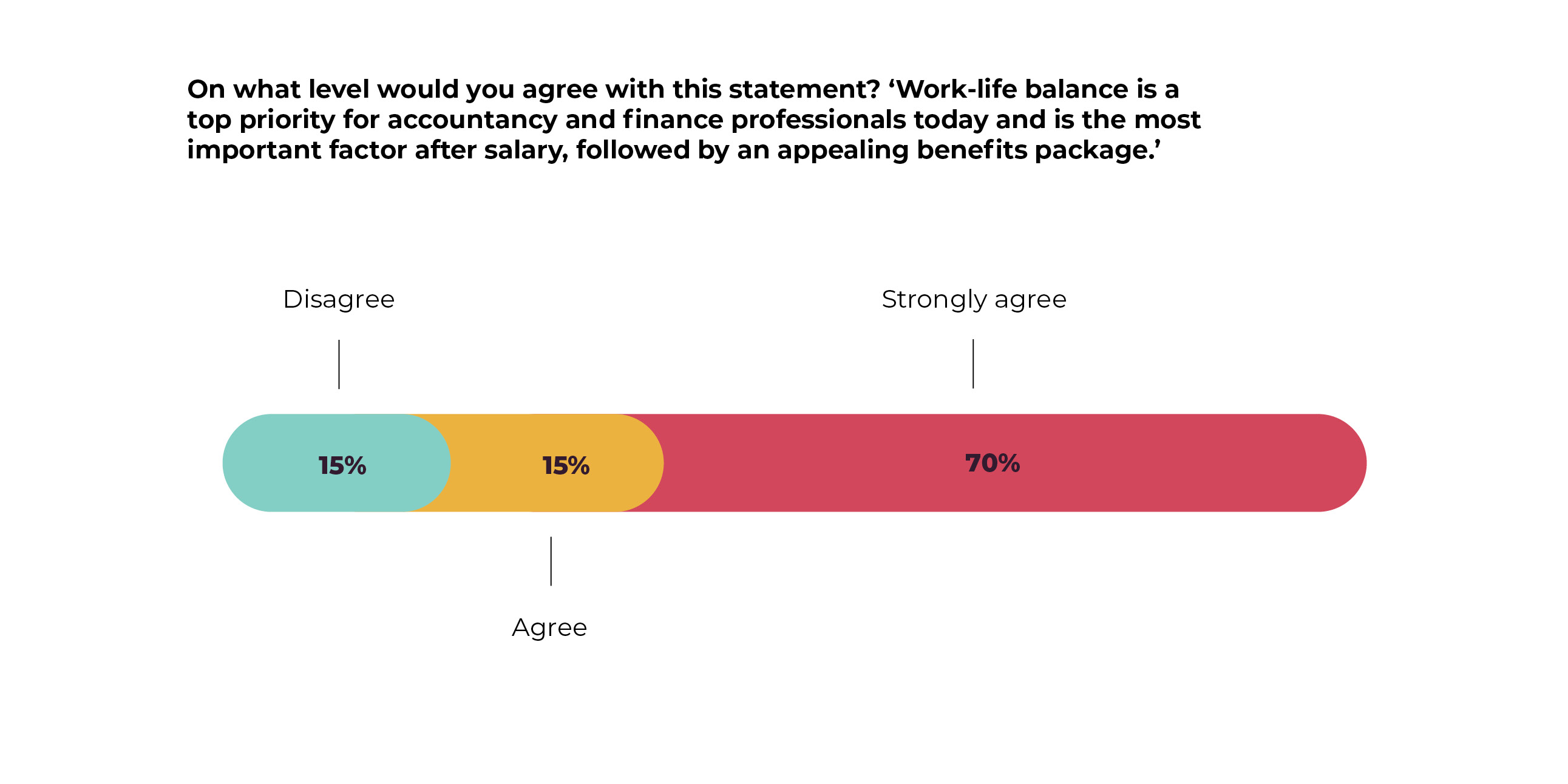

Nearly 90% of public sector professionals ‘agree’ or ‘strongly agree’ with the statement ‘Work-life balance is a top priority for accountancy and finance professionals today and is the most important factor after salary, followed by an appealing benefits package.’

Despite our findings, we also found that 52% of professionals are satisfied with their current earnings. Interestingly, 63% of public sector professionals are confident they will earn their desired salary if they stay in their current role.

Private sector recruitment trends

Over in the private sector, our report found that 25% of private sector professionals cite flexibility as the most important perk in 2025. A further 22.5% cited remote work as their most preferred perk.

More than half (60%) of private sector professionals don’t believe that their current salary and benefits reflect their value. However, when asked if they would stay in a role with a lower salary if there was a promise of a salary increase in the future, 30% of respondents said they would.

Of the respondents who cited ‘they don’t know’ or ‘it would depend,’ the reasons included:

- The opportunity the role offered.

- Pros and cons of the job - including work-life balance, benefits, and holiday entitlement.

- The monetary value and package that comes with a new role or additional responsibilities.

- Whether Continued Professional Development was encouraged.

- If the promise of a higher salary is clearly defined in relation to hitting targets.

Accountancy insights

The data within this section details the findings from just accountancy professionals.

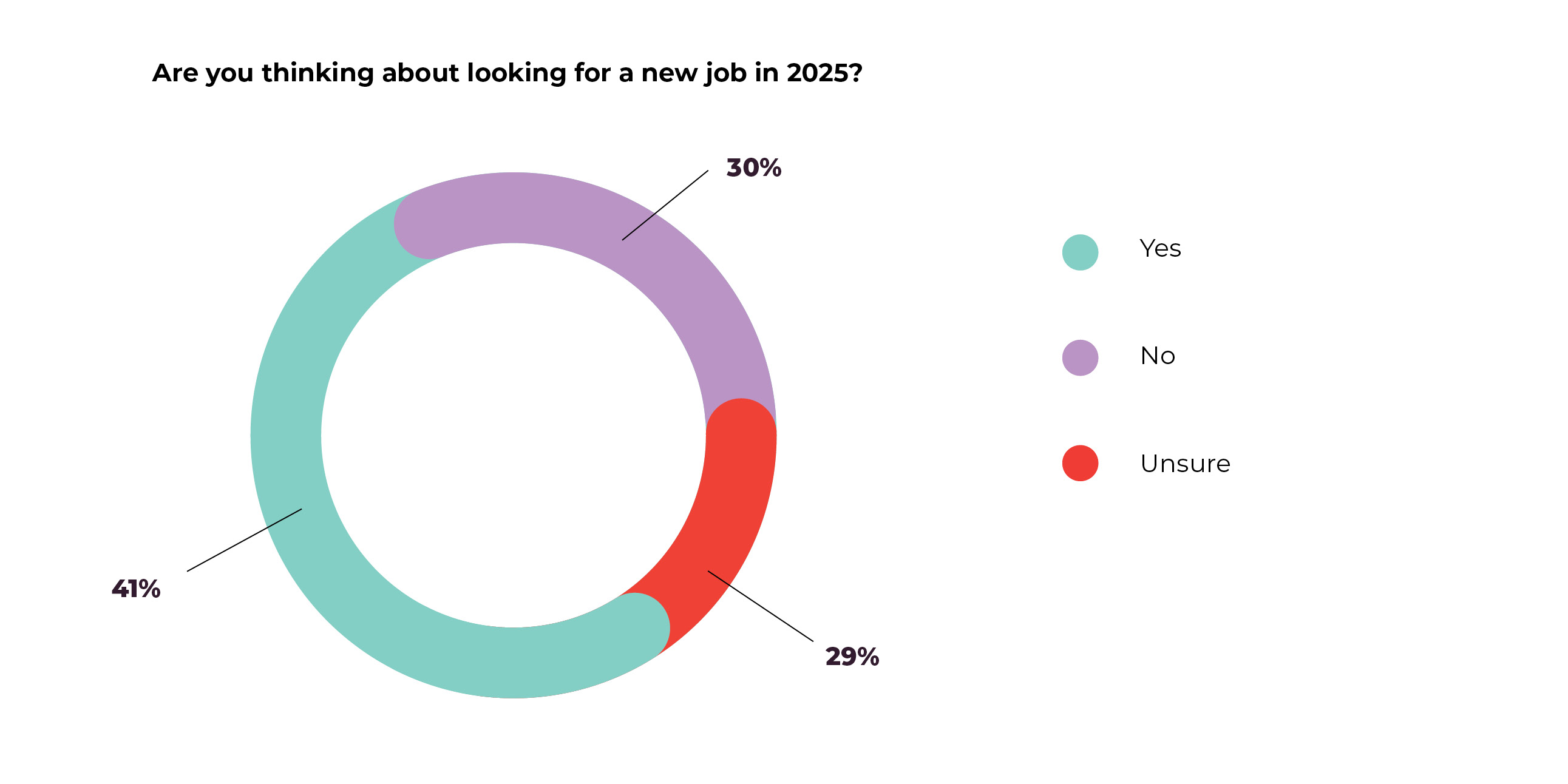

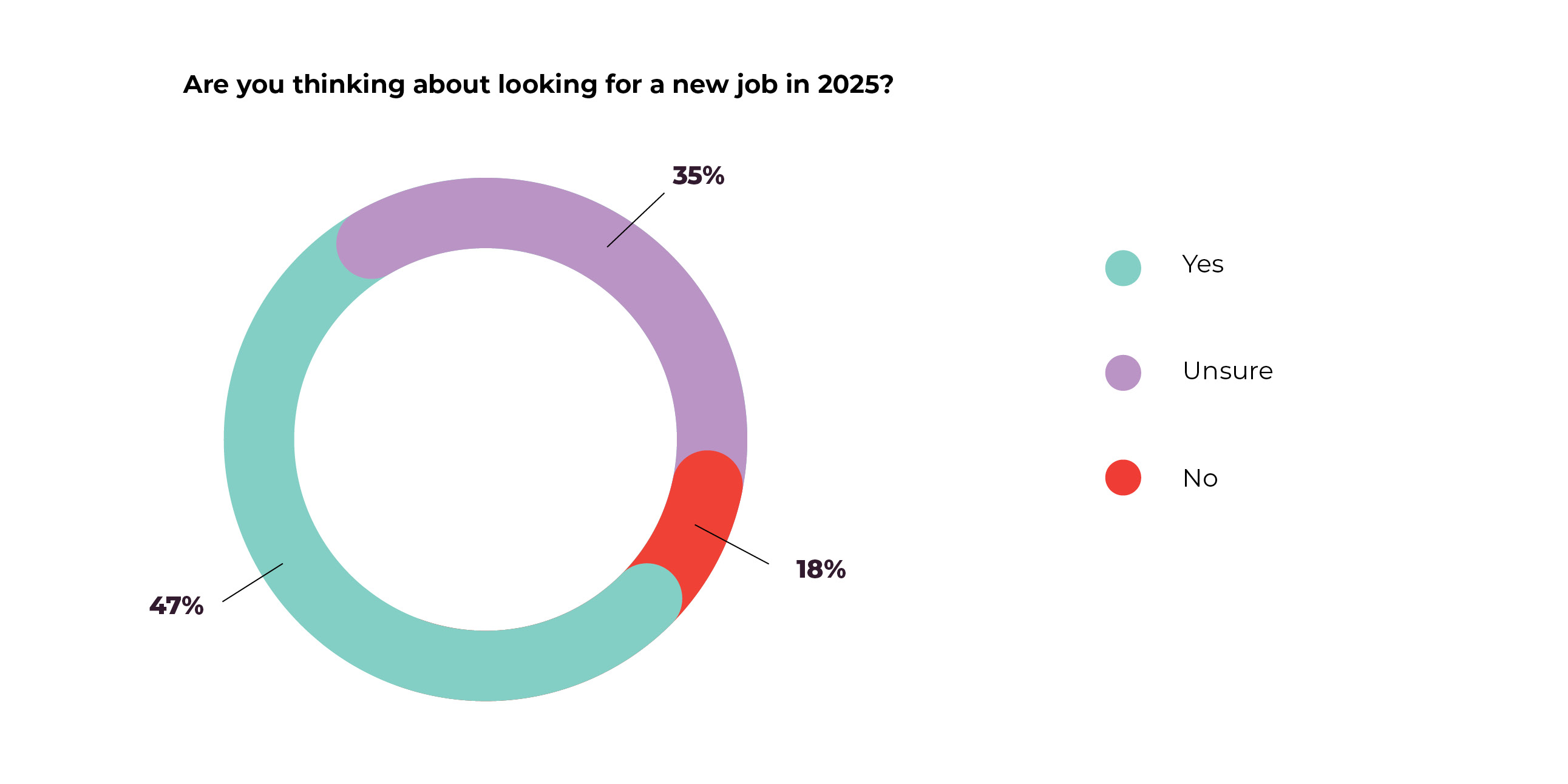

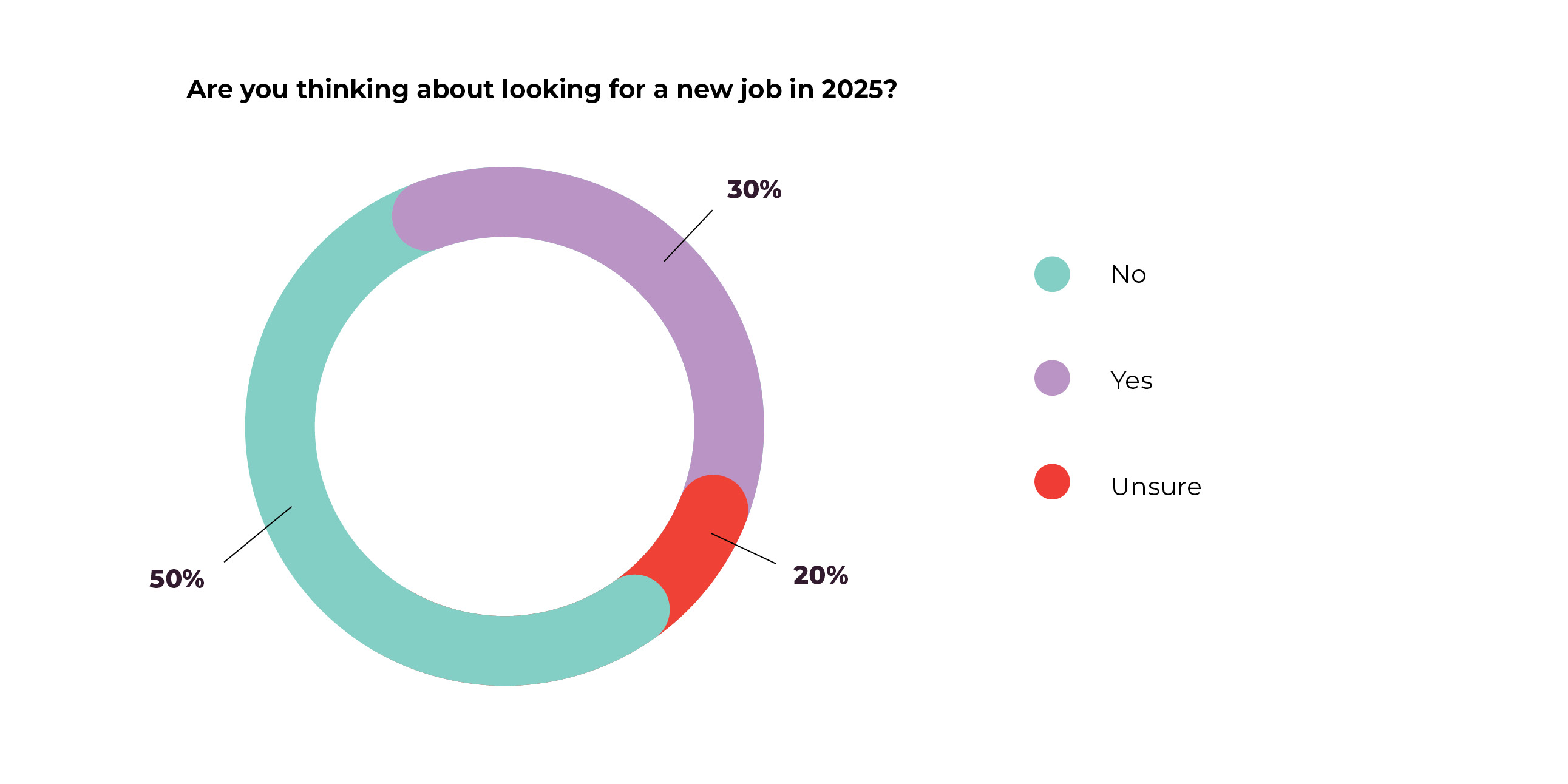

Are you thinking about looking for a new job in 2025?

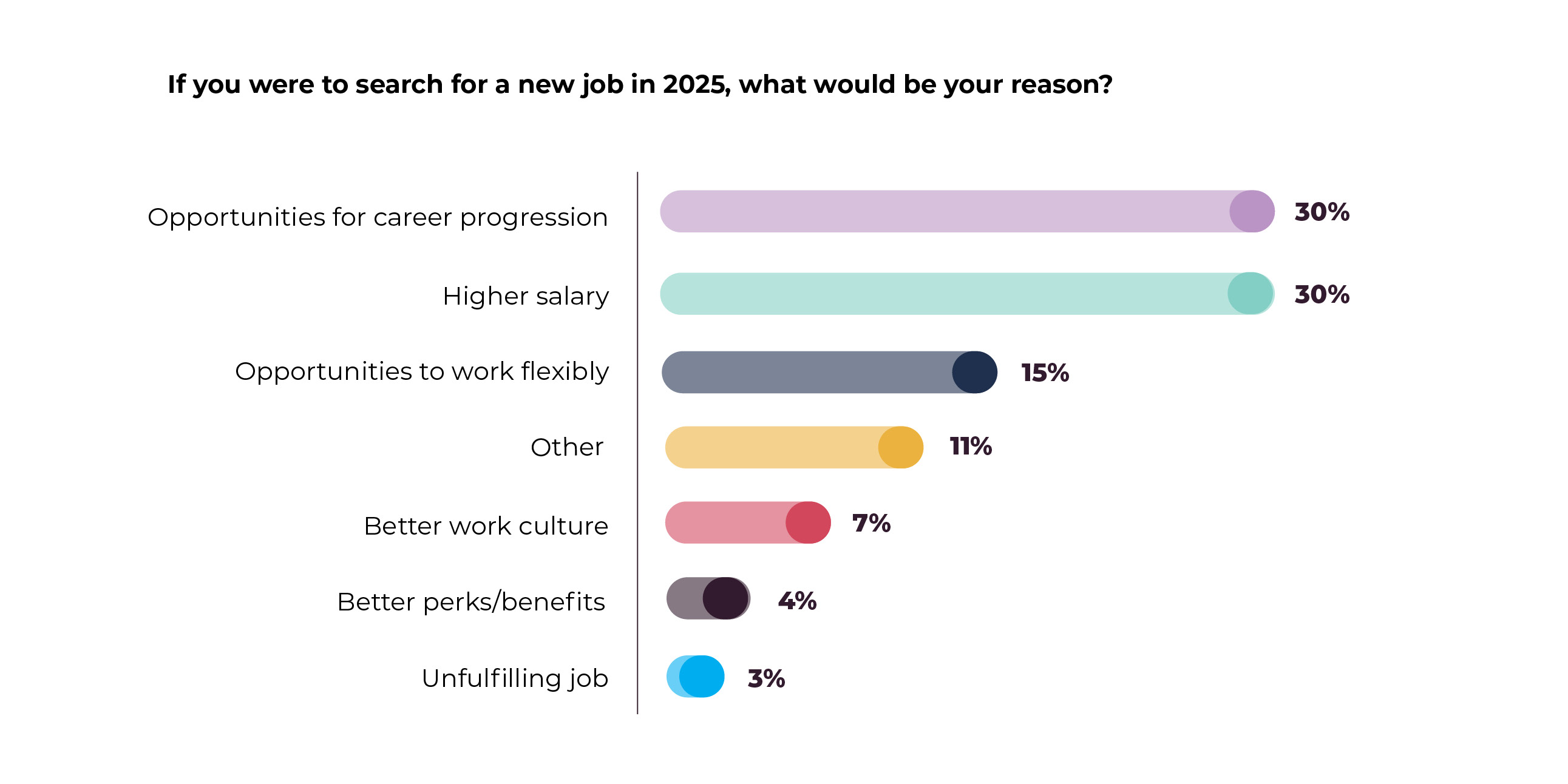

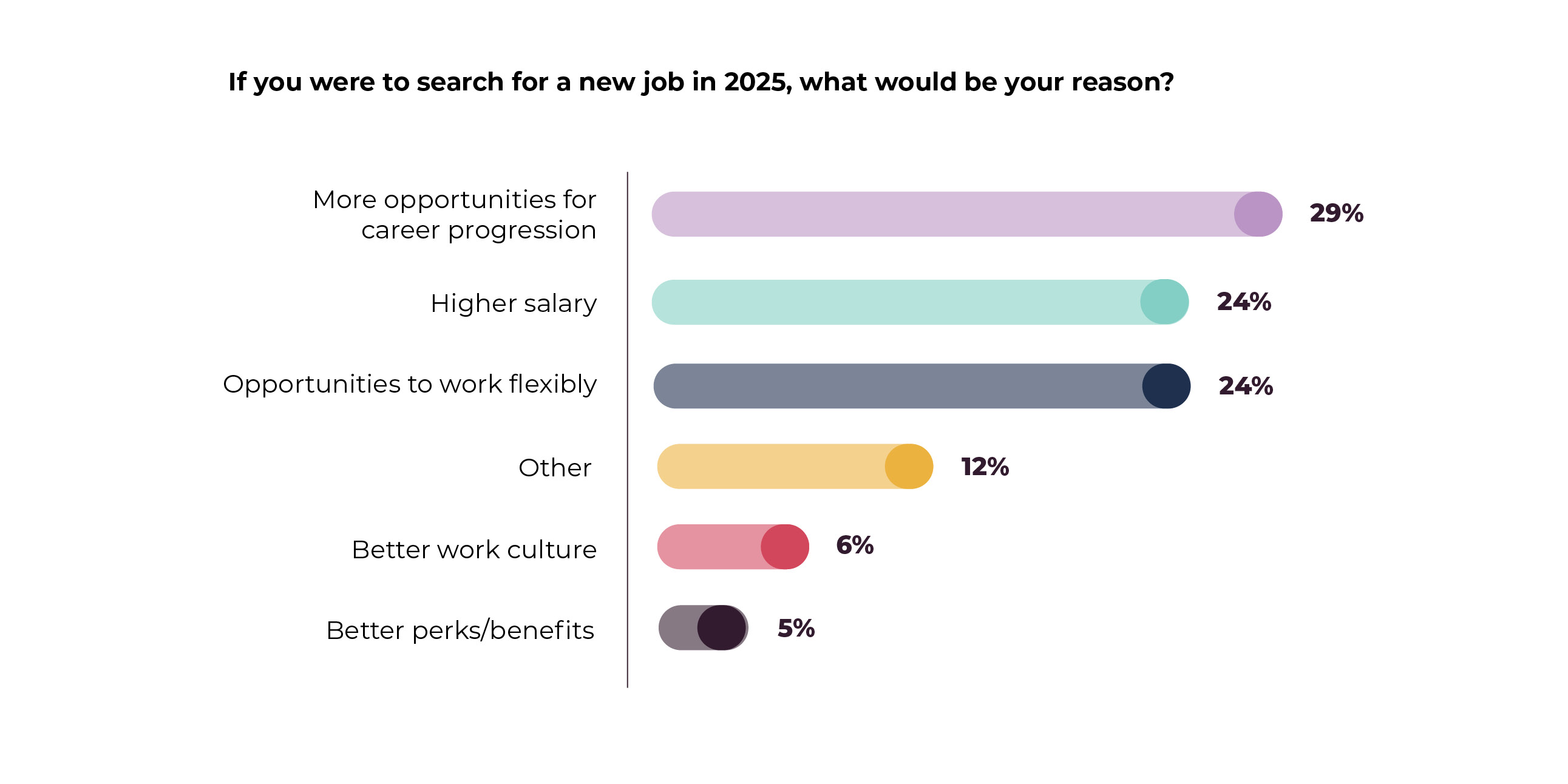

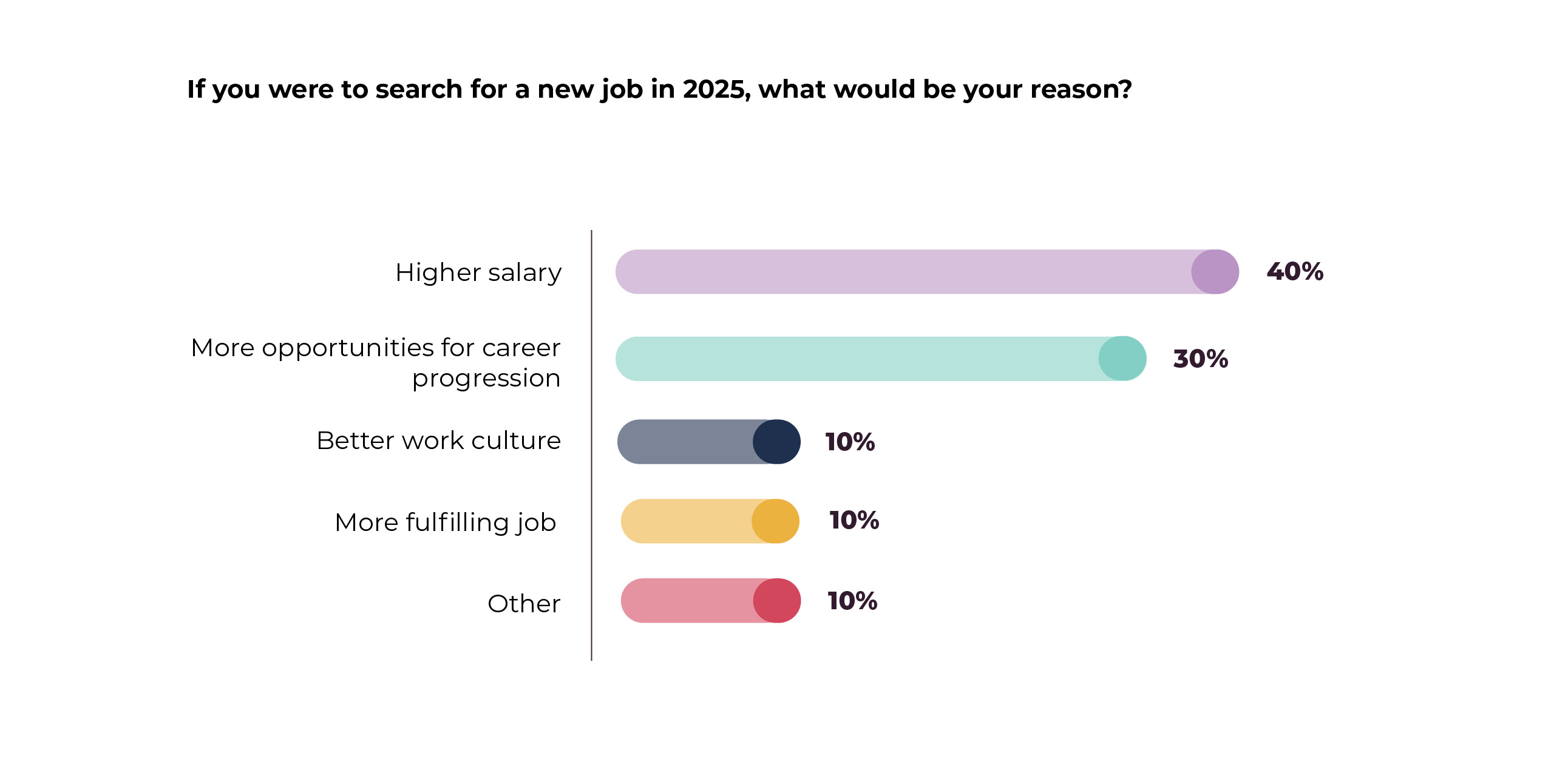

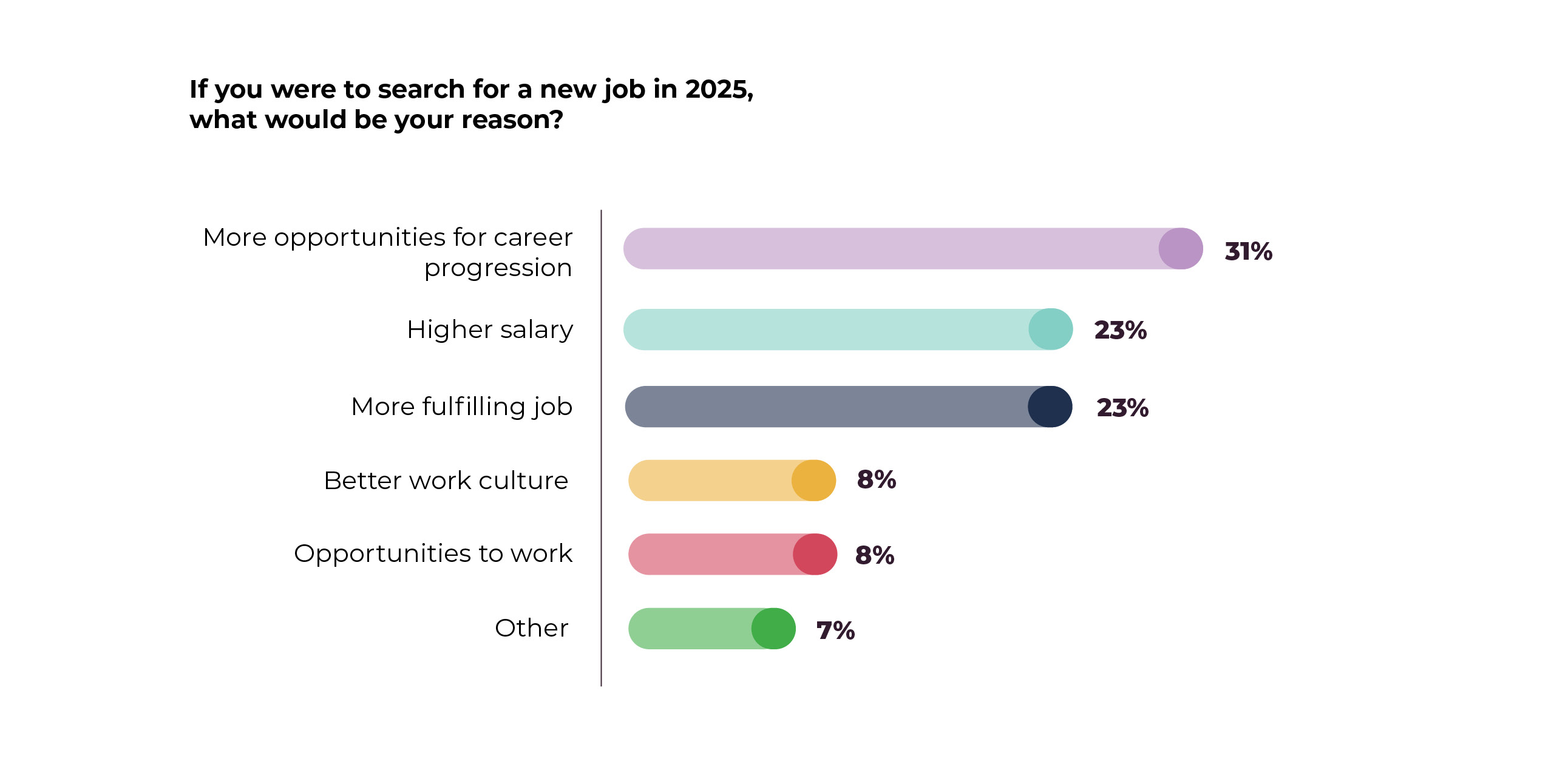

If you were to search for a new job in 2025, what would be your reason?

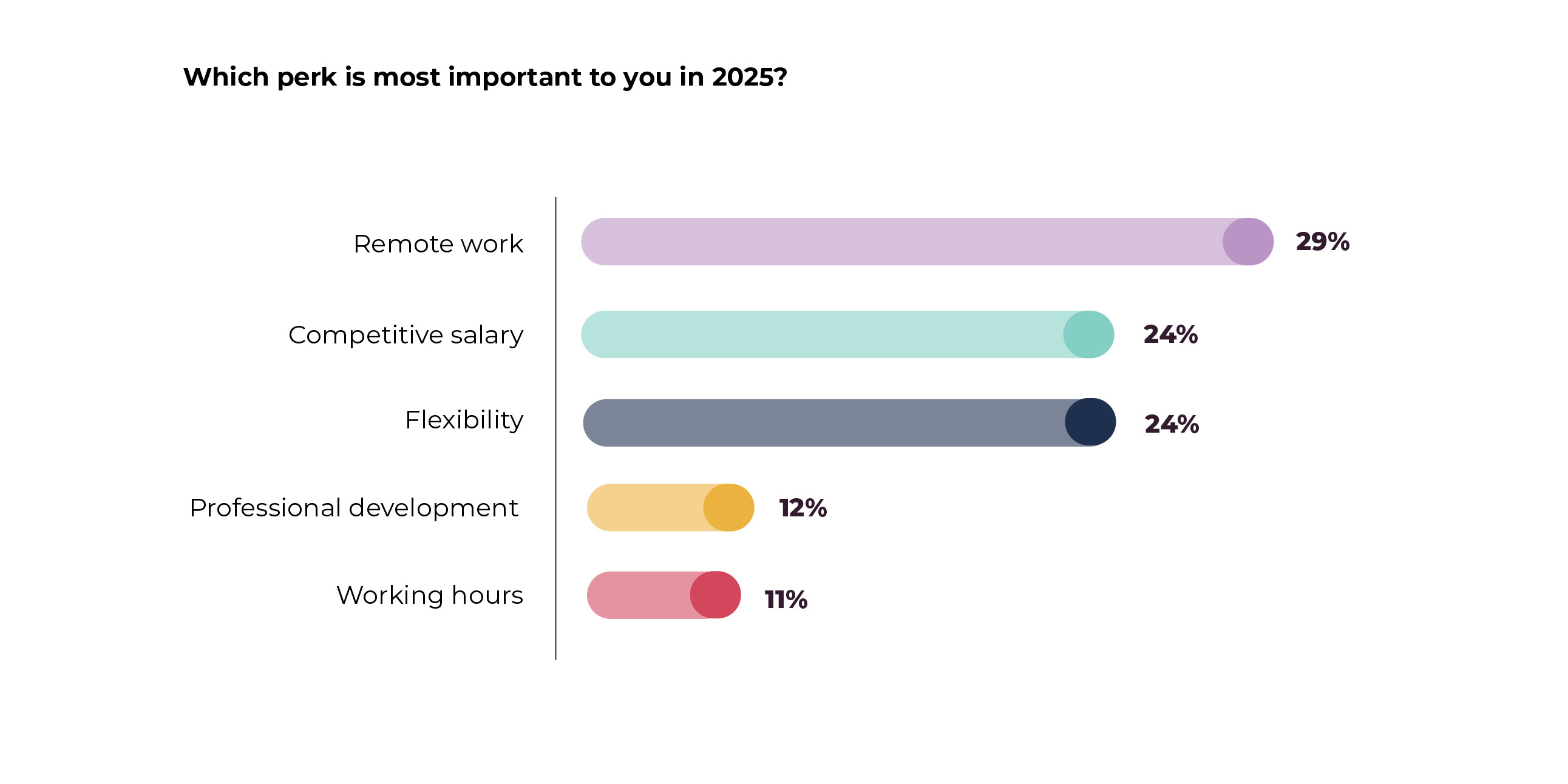

Which perk is most important to you in 2025?

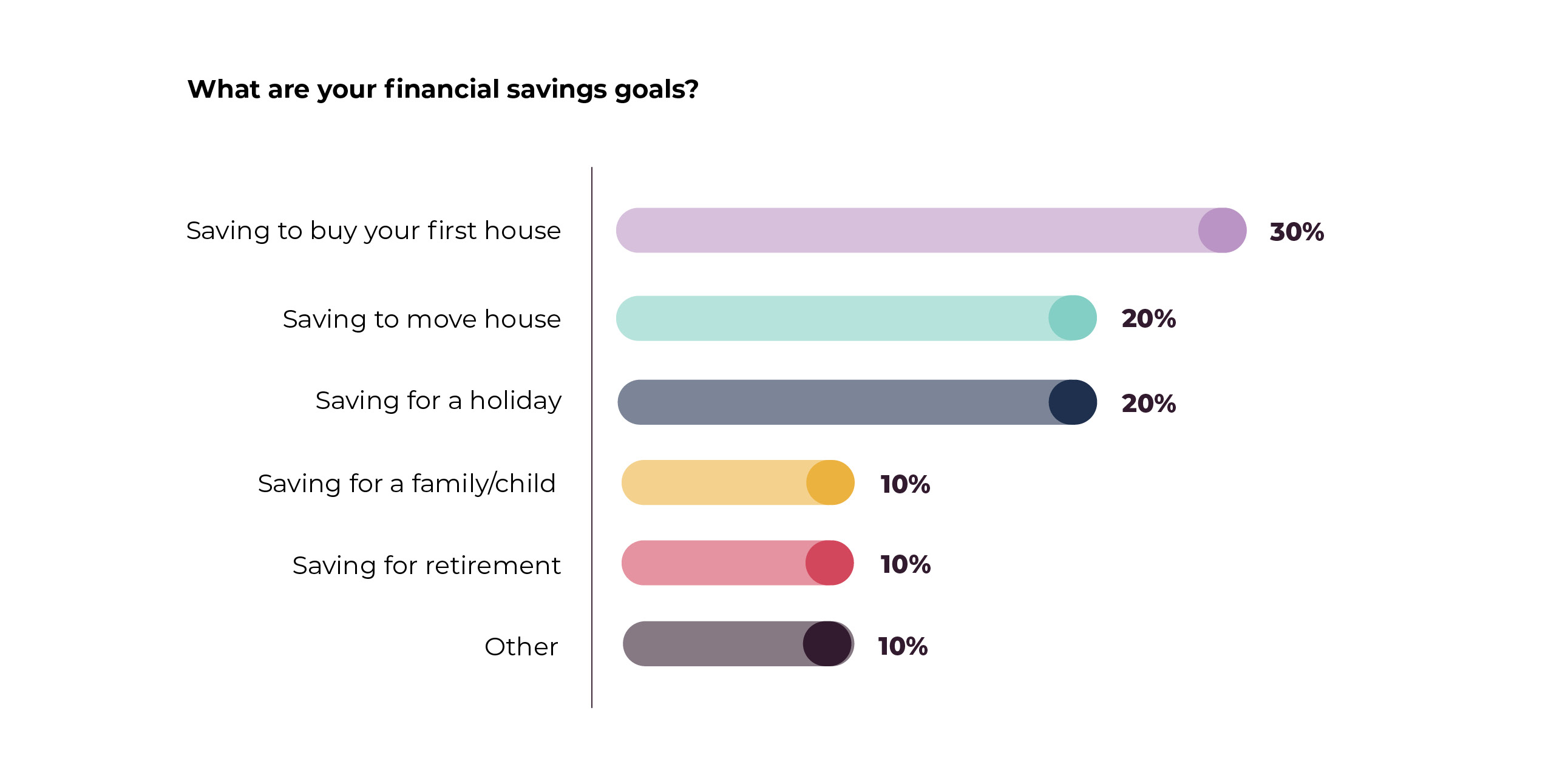

What are your financial savings goals?

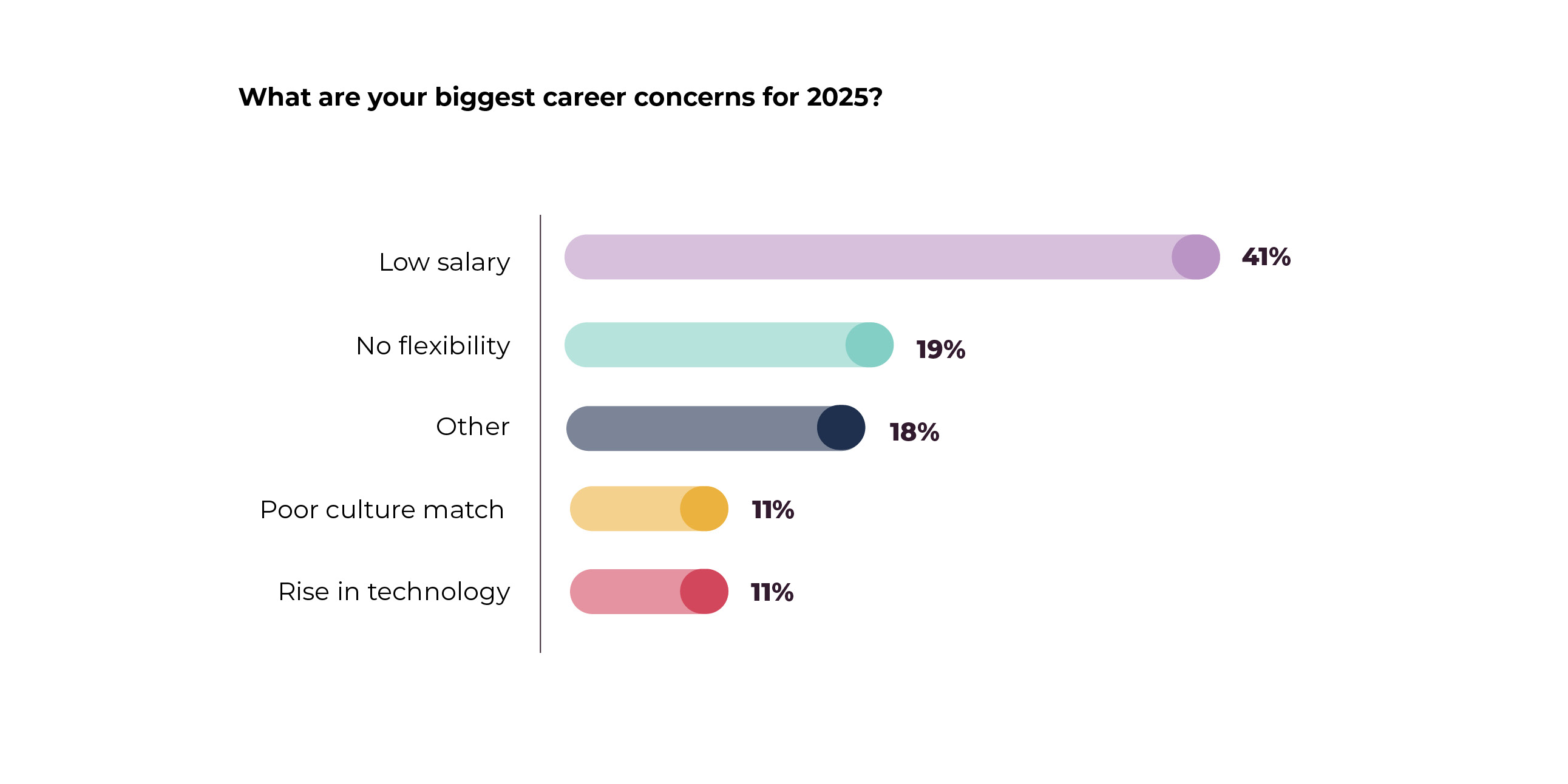

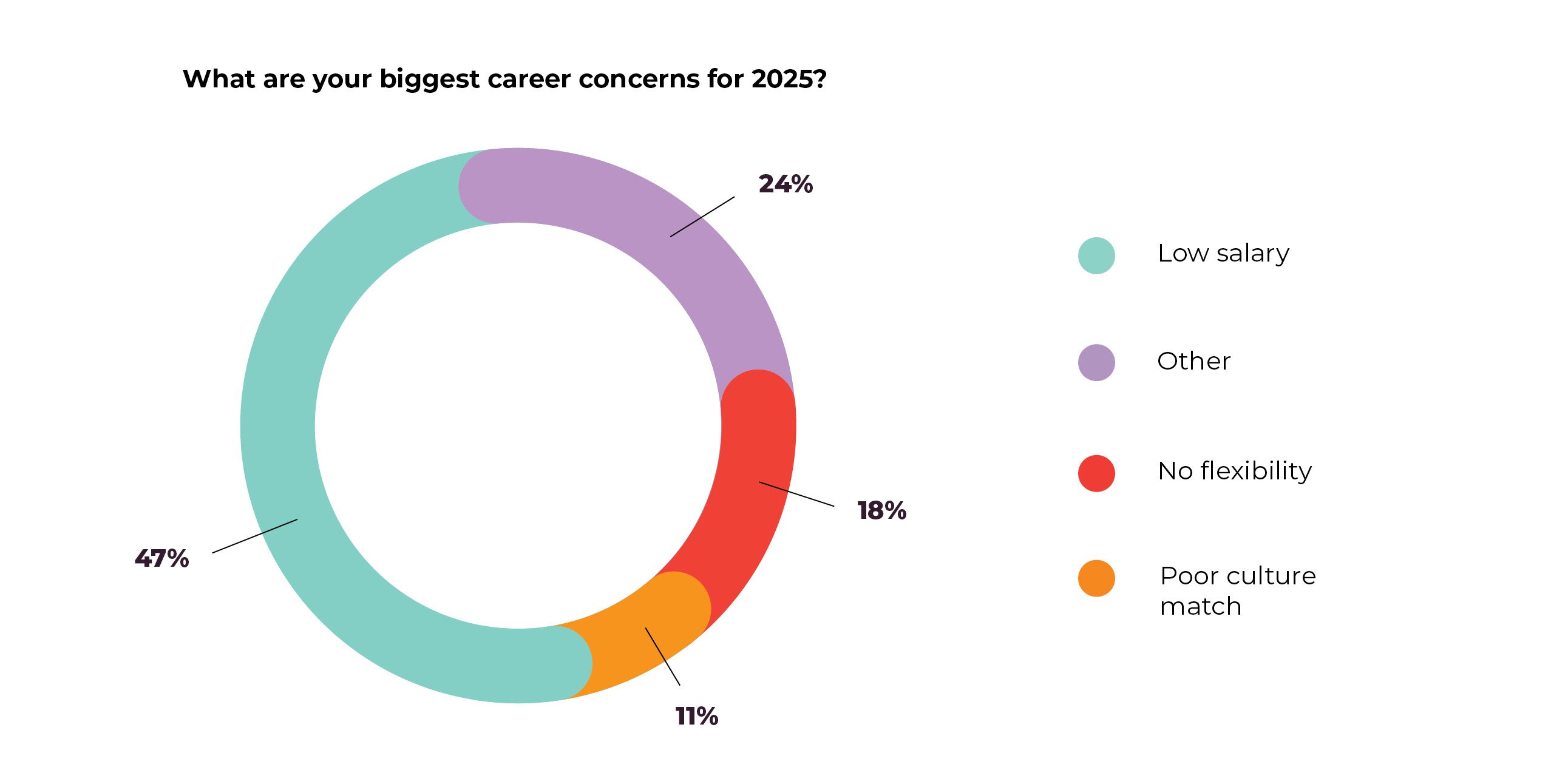

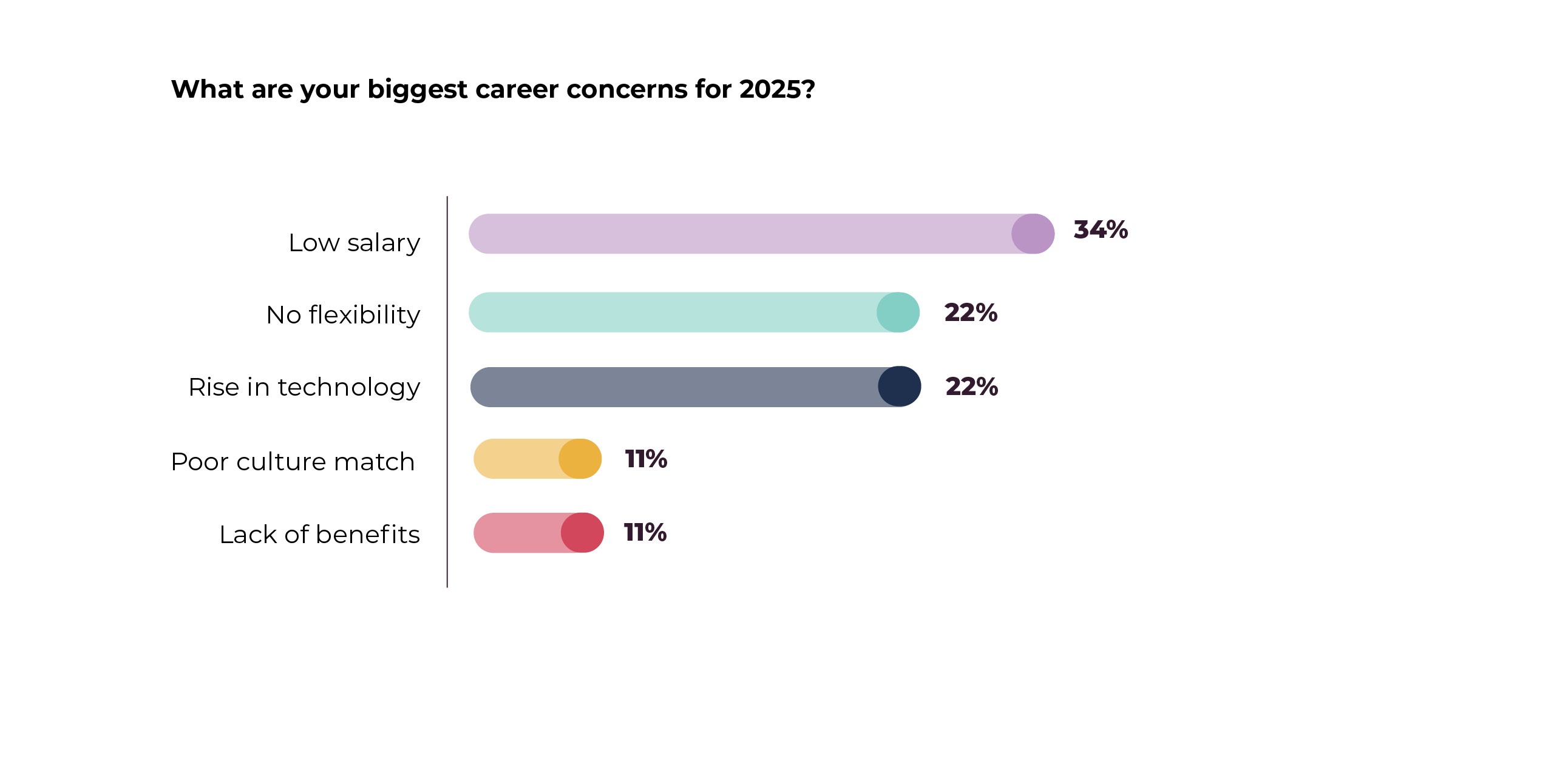

What are your biggest career concerns for 2025?

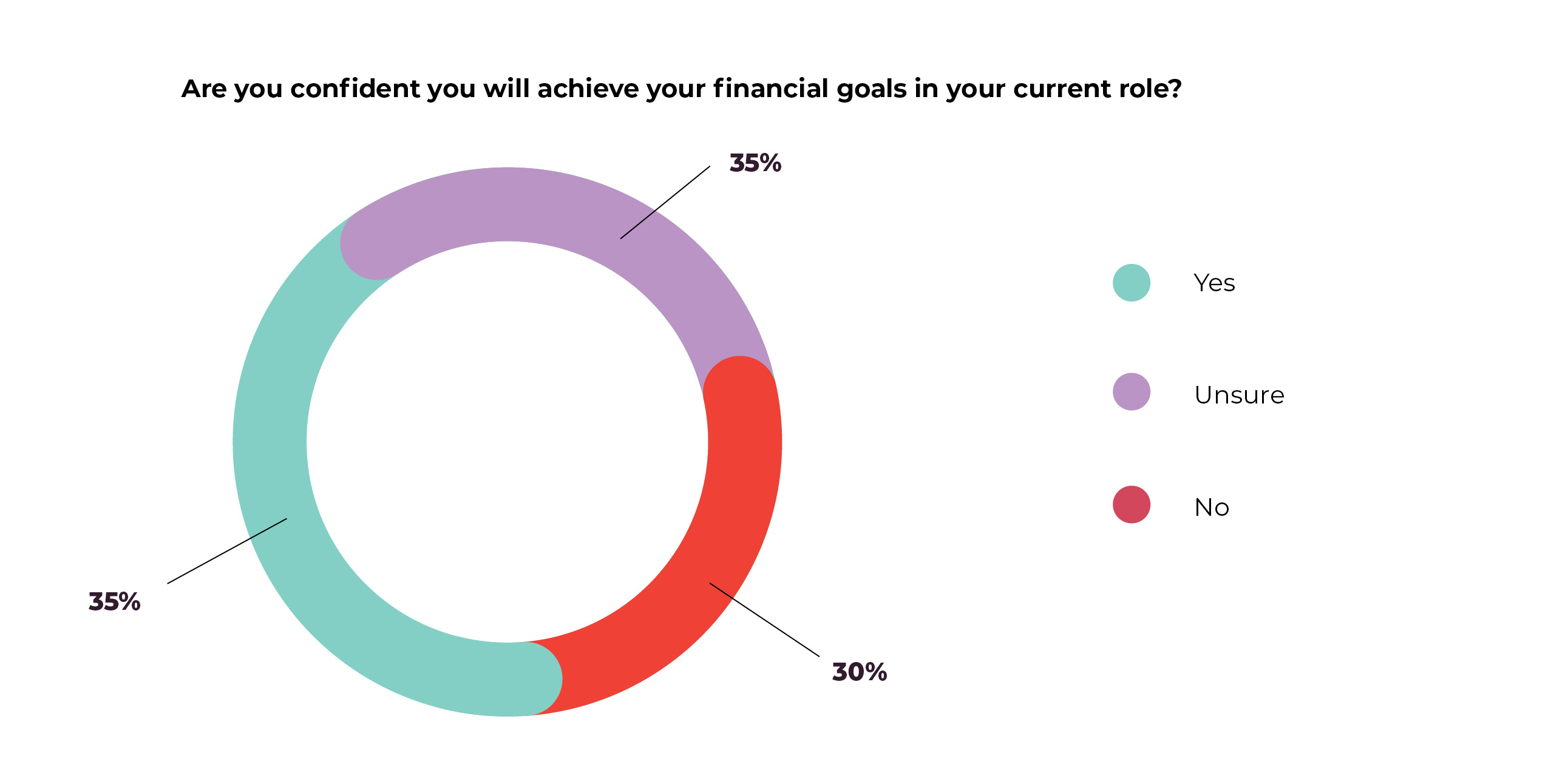

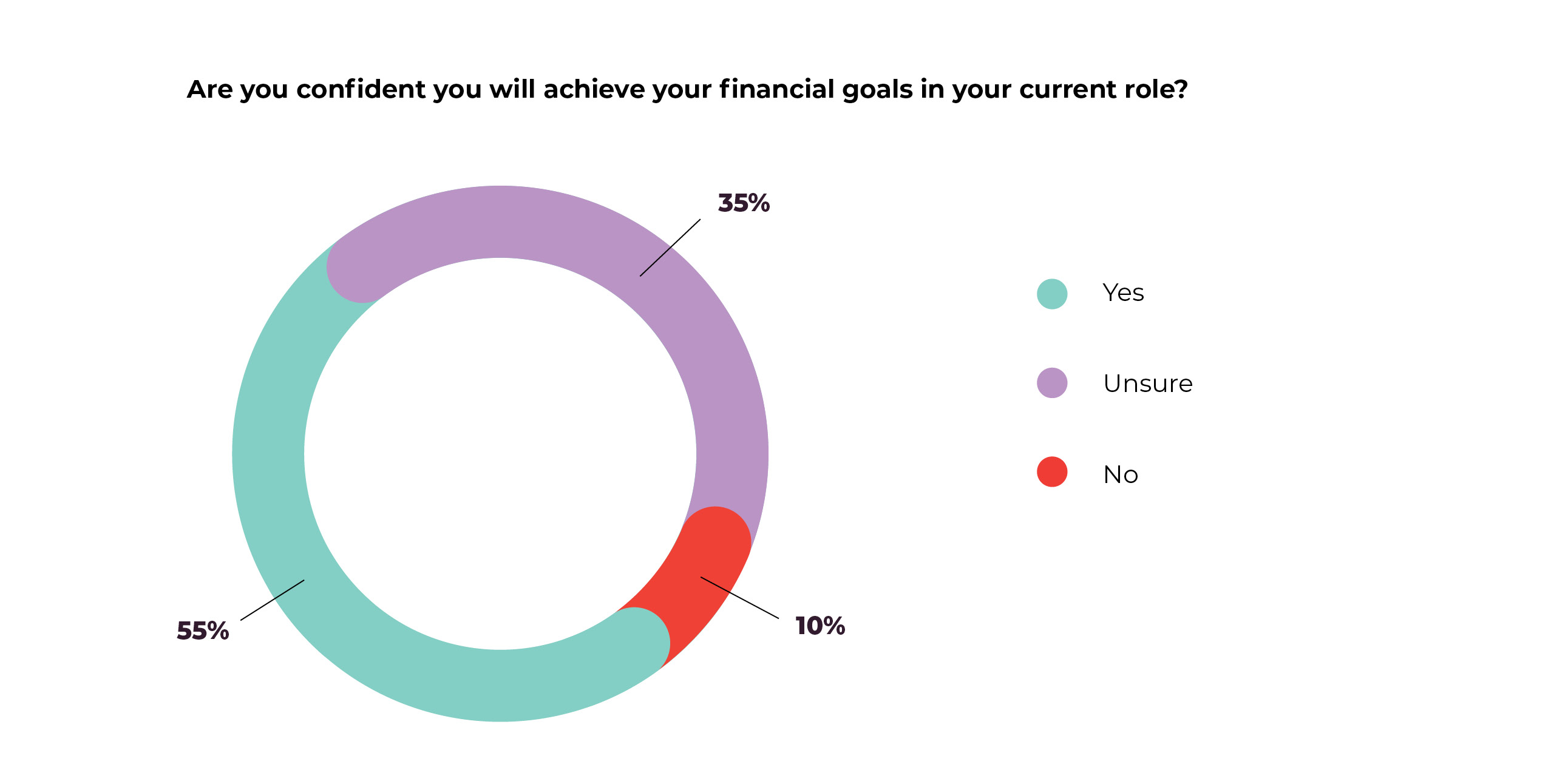

Are you confident you will achieve your financial goals in your current role?

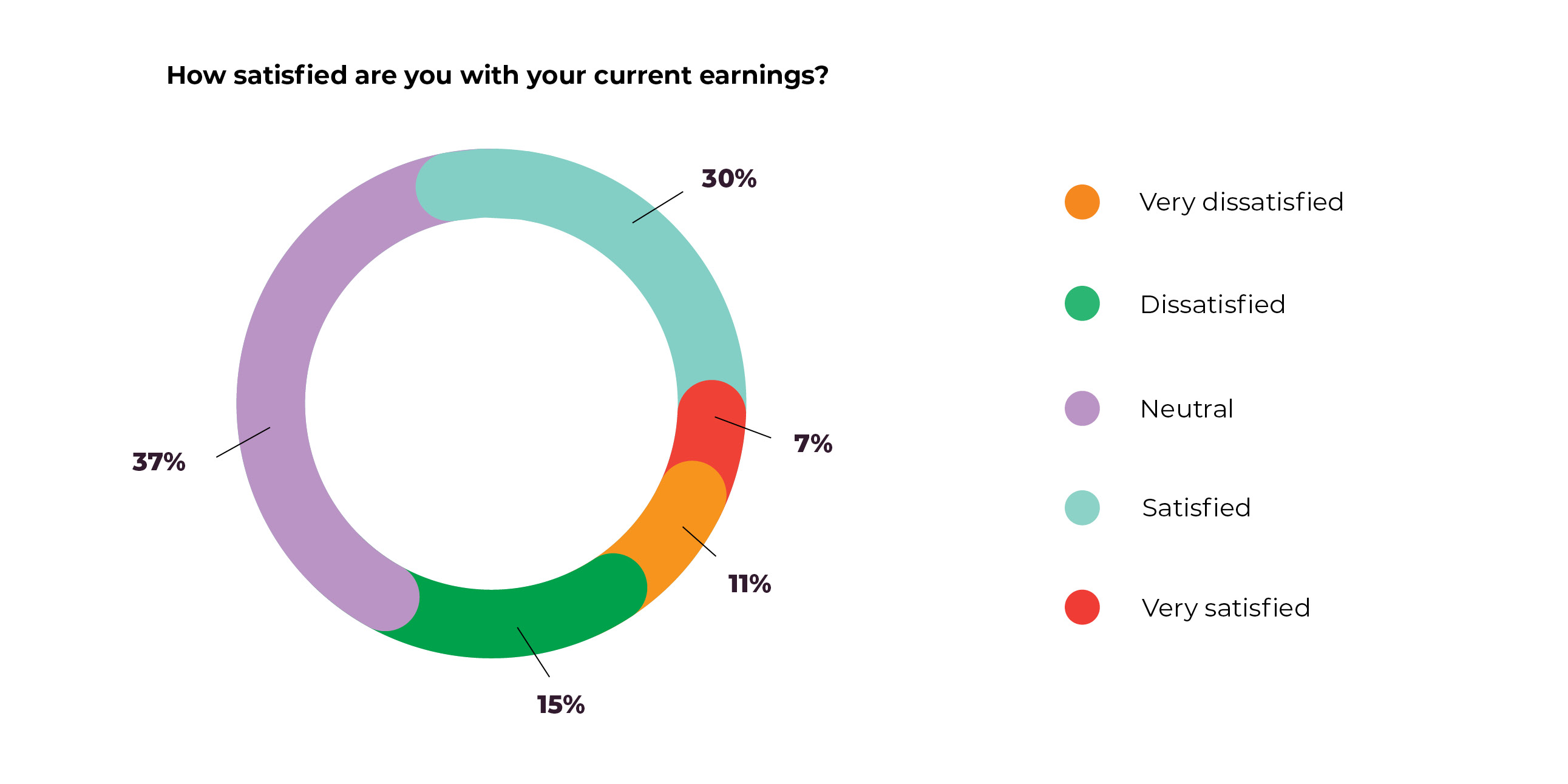

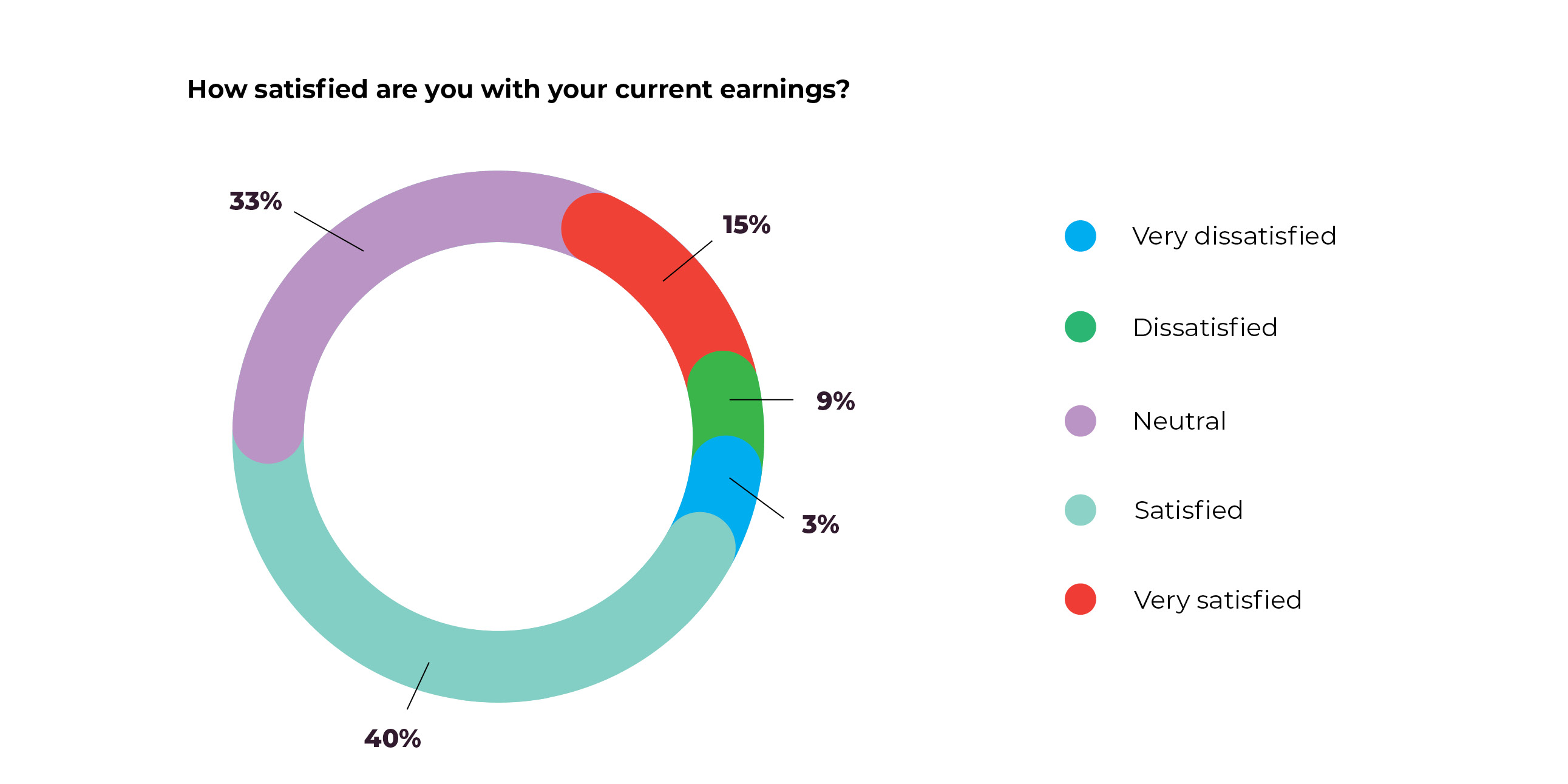

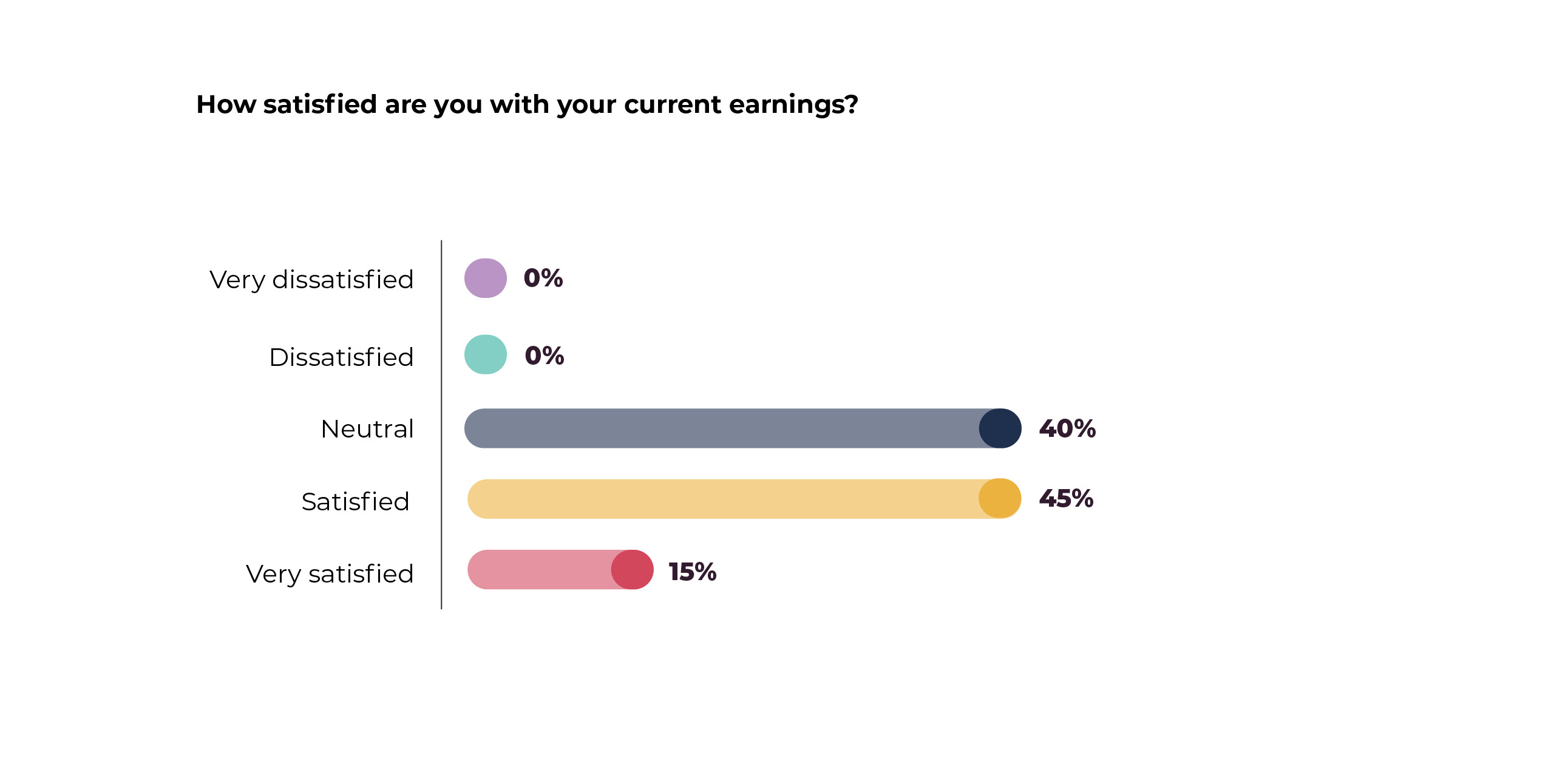

How satisfied are you with your current earnings?

Key priorities for accountancy professionals

With 41% of accountancy professionals considering searching for a new job in 2025, and a further 29% unsure, it is clear that employers must ‘up their game’ if they wish to retain their top talent.

One junior in the accountancy profession said, “By 2025, accountancy and finance professionals will continue to seek a well-rounded combination of competitive compensation, work-life balance, and professional growth.”

Unsurprisingly a higher salary and opportunities for career progression lead the way in reasons for this trend. Though potentially not a ‘deal breaker’, flexibility was the lead driving force for both males (32%) and females (26%) when it comes to preferred perks.

Another junior said, “The flexibility to work from home is very important.”

For employers who can’t financially offer higher salaries, career progression opportunities and flexible working could be a way of differentiating themselves in the job market and attracting top talent.

Accountancy: male insights

The data within this section of the report details the findings from only male accountancy professionals.

A junior in the accountancy profession said, “The shift in priority for men in accountancy from salary to work-life balance reflects the growing demand for flexible work arrangements, reduced stress, and a healthier overall lifestyle.”

He added, “Beyond a competitive salary, an attractive benefits package - such as remote work options, flexible hours, mental health support, and paid time off - is now essential to attract and retain top talent in the sector.”

Are you thinking about looking for a new job in 2025?

If you were to search for a new job in 2025, what would be your reason?

What are your biggest career concerns for 2025?

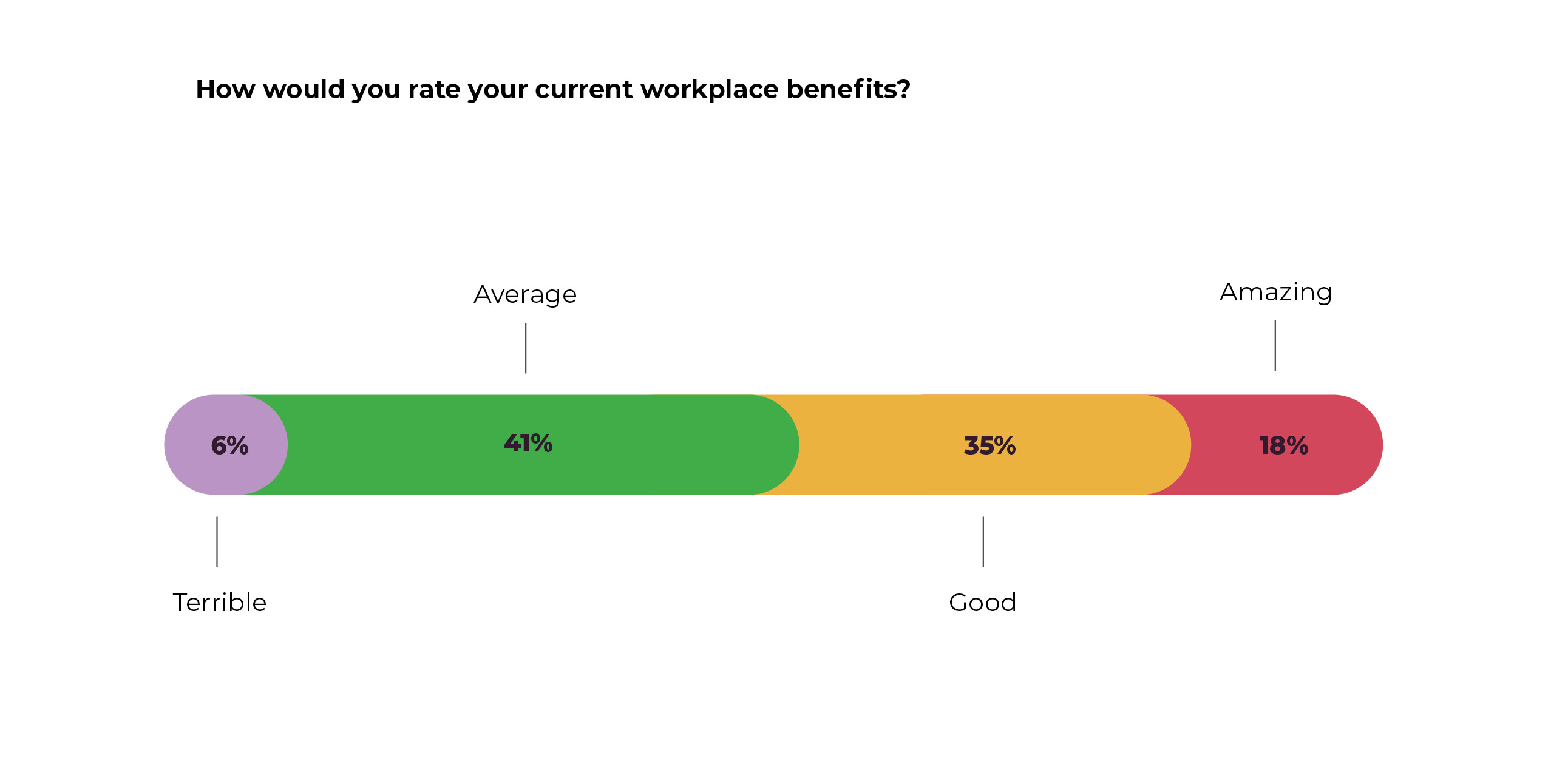

How would you rate your current workplace benefits?

Which perk is most important to you in 2025?

Are you confident you will achieve your financial goals in your current role?

Would you accept a lower salary for better work-life balance?

Key priorities for male accountancy professionals

Unsurprisingly, male accountancy professionals cite a higher salary and further career progression opportunities (which in itself could warrant a higher salary) as their key priorities for 2025.

One male respondent stated, “Work-life balance has become a critical priority for accountancy and finance professionals, second only to salary in terms of importance.”

Despite only 6% of male accountancy professionals wishing to leave their job for a better work culture, the comments suggest that work culture is still extremely important to the majority of professionals.

An Assistant Manager said, “Most people leave practice due to the poor work-life balance that it causes. Superficial benefits such as private medical cover does not help to improve people’s wellbeing while a better work-life balance would definitely help this.”

53% of male accountancy professionals believe culture is ‘important’ when looking for a job. A further 47% said it was ‘very important.’ That being said, 71% wouldn’t accept a lower salary for a better work-life balance.

Another respondent stated, “Company culture is a highly important factor for jobseekers, often ranking just behind salary and benefits in terms of priority. A positive, inclusive, and supportive culture can significantly impact job satisfaction, employee engagement, and overall well being.”

Accountancy: female insights

The data within this section of the report details the findings from only female accountancy professionals.

Are you thinking about looking for a new job in 2025?

If you were to search for a new job in 2025, what would be your reason?

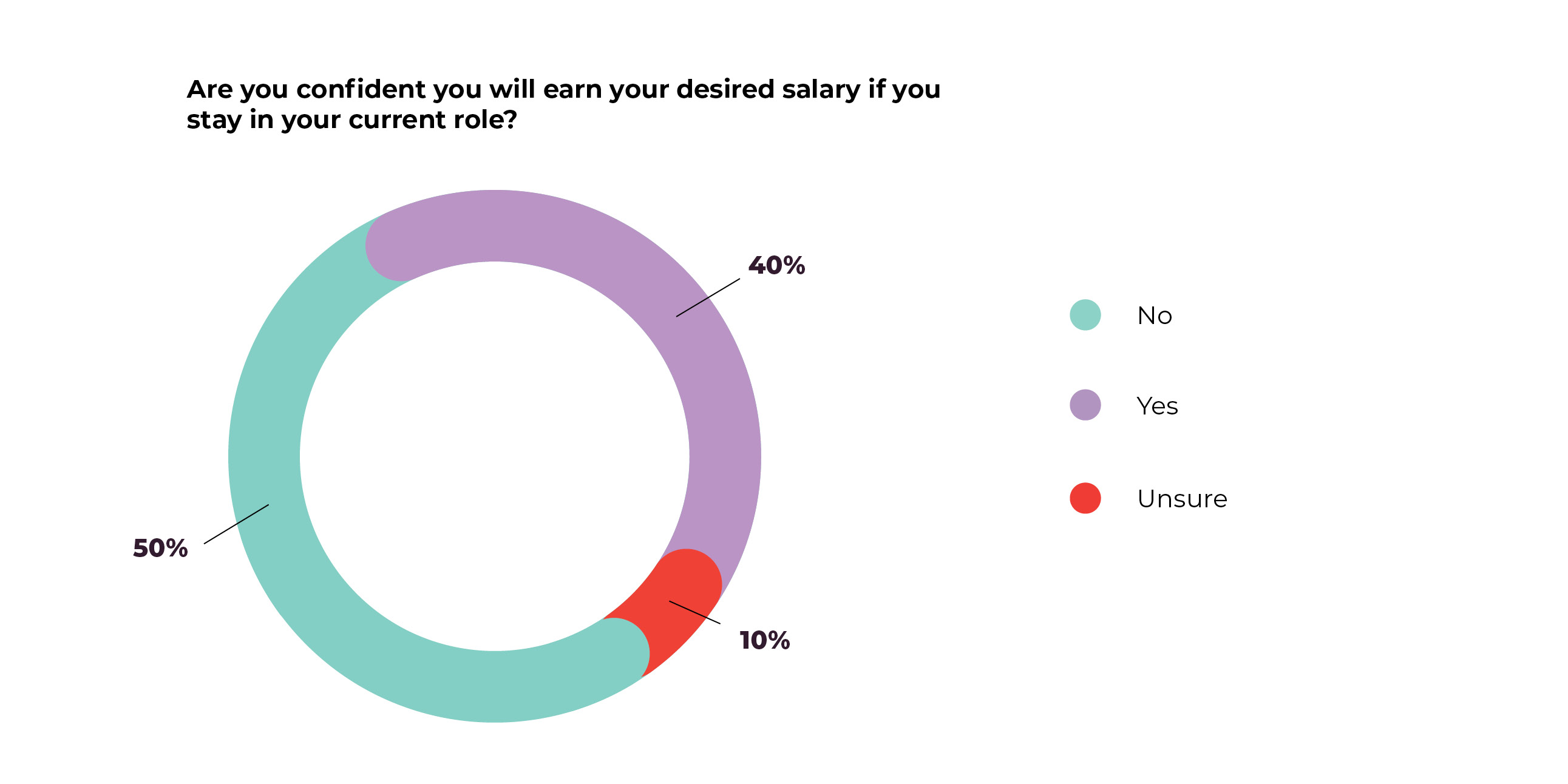

Are you confident you will earn your desired salary if you stay in your current role?

What are your biggest career concerns for 2025?

What are your financial savings goals?

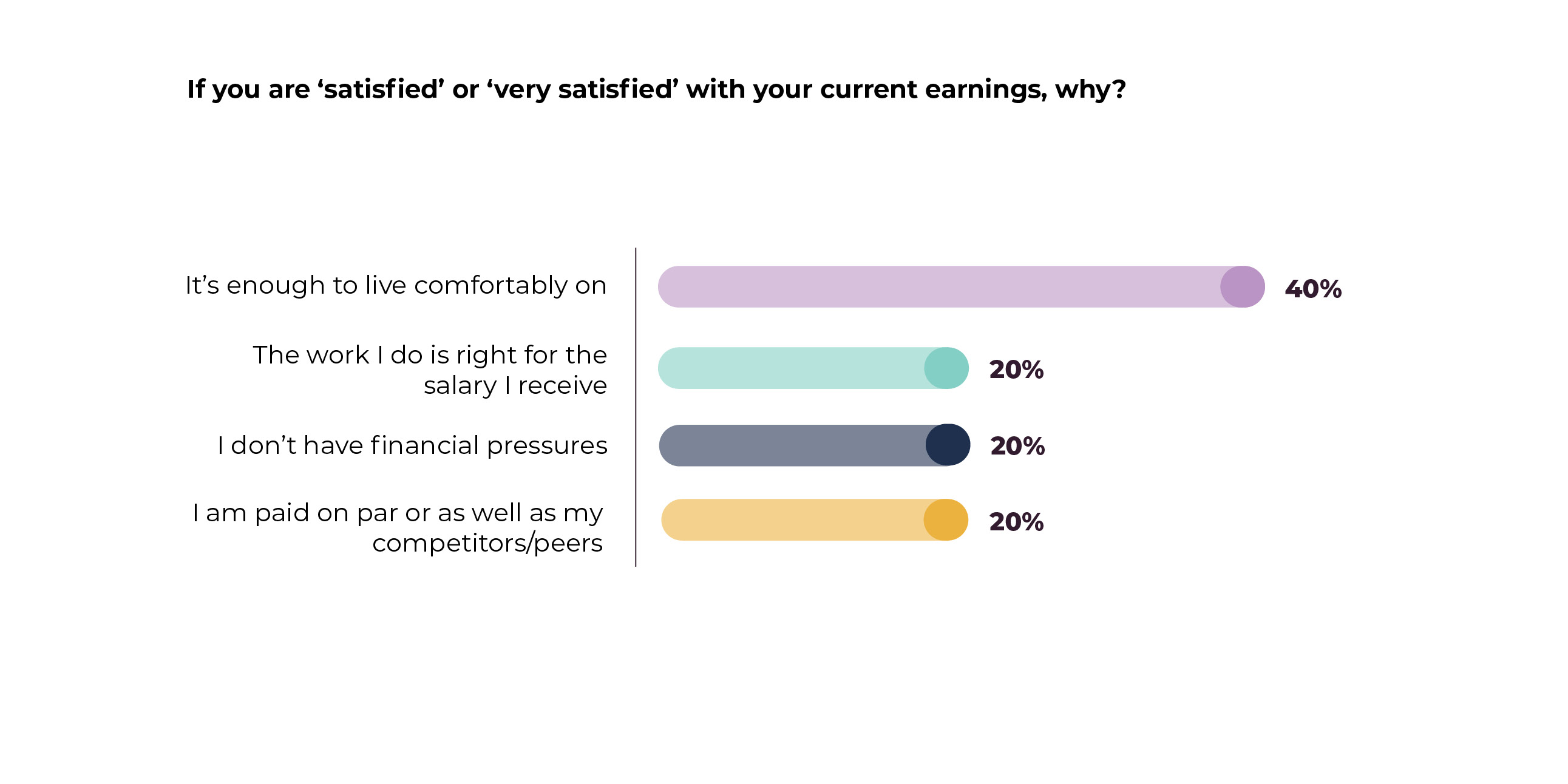

If you are ‘satisfied’ or ‘very satisfied’ with your current earnings, why?

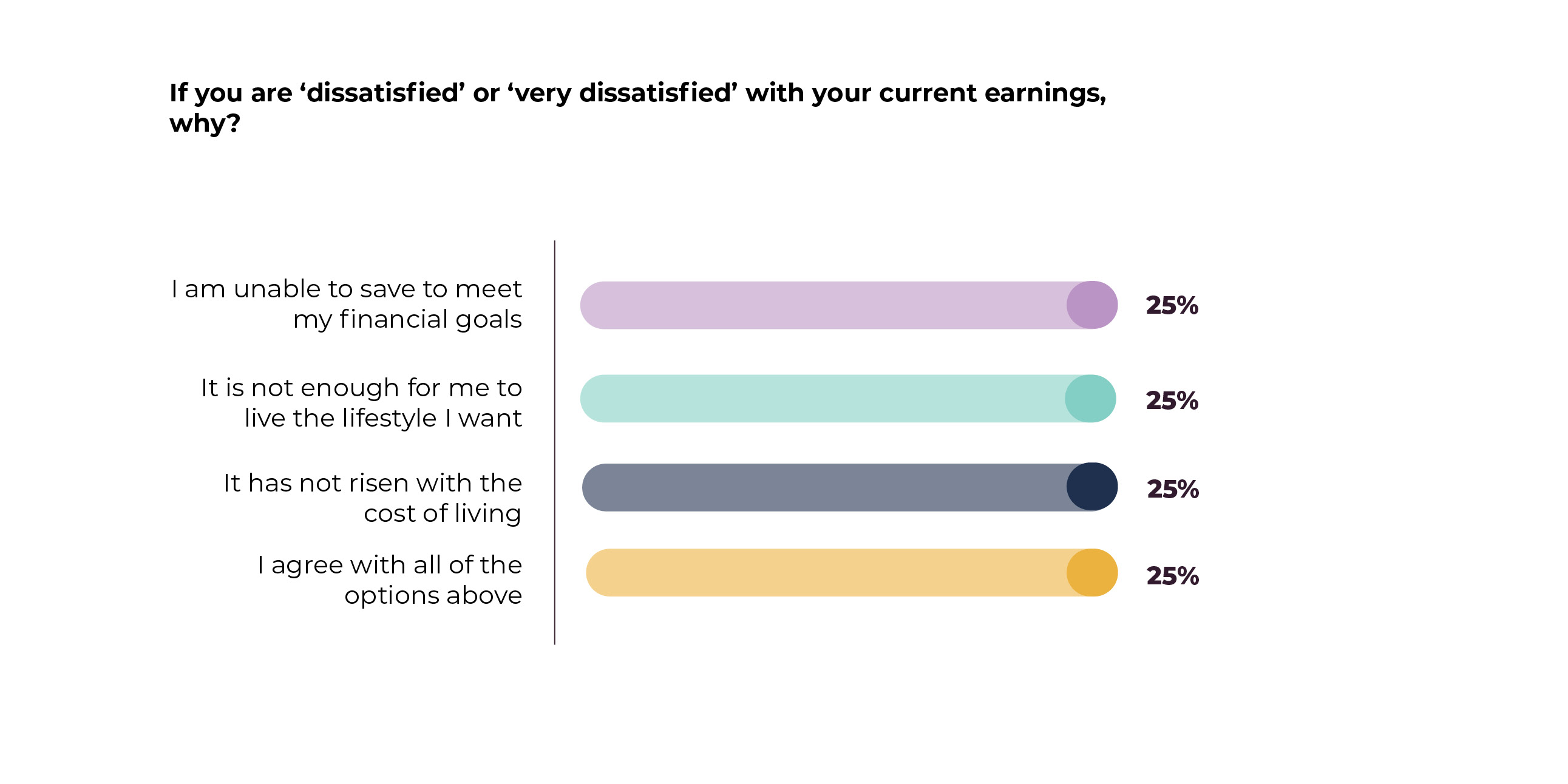

If you are ‘dissatisfied’ or ‘very dissatisfied’ with your current earnings, why?

Key priorities for female accountancy professionals

With 50% of female respondents citing that they won’t earn their desired salary in their current role, and 10% unsure, 2025 could result in a scenario akin to the great resignation of 2022.

One female respondent, “We’re looking for the salary to start reflecting that we’re skilled professionals.”

With women accounting for approximately 46% of all Accountants and Auditors in the UK (according to the Association of Chartered Certified Accountants (ACCA)), it’s clear that employers must act fast if they wish to retain their top female talent.

Interestingly, 50% of financial goals surrounded living arrangements (30% saving to buy their first house and 20% saving to move house) which indicates that no amount of perks, work-culture, pensions or healthcare insurances could remedy this desire.

One female respondent stated: “I am not bothered about benefits, so long as the pay is reasonable.”

Finance insights

The data within this section of our report details the findings from only finance professionals.

What are your biggest career concerns for 2025?

How satisfied are you with your current earnings?

What are your financial savings goals?

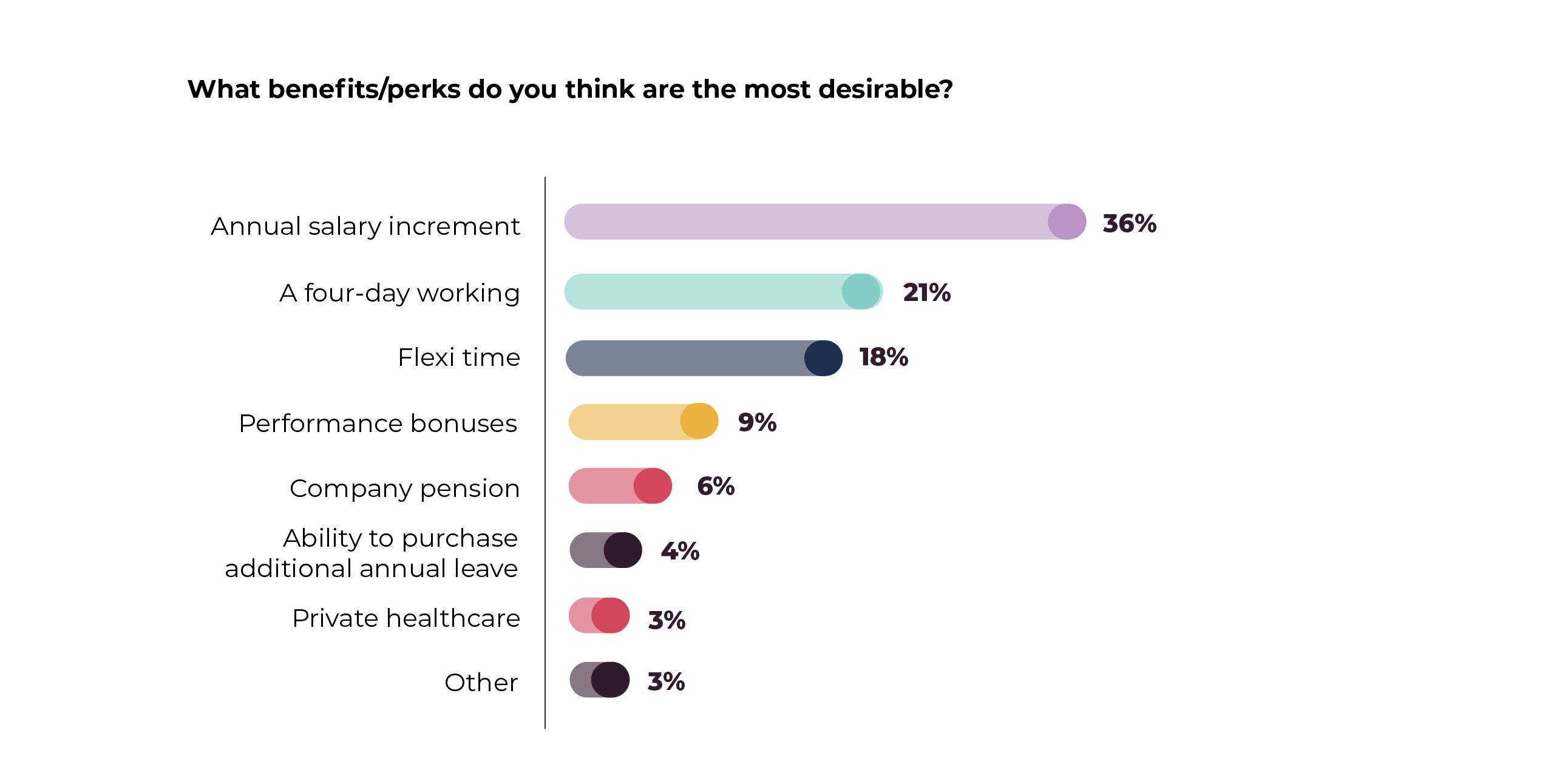

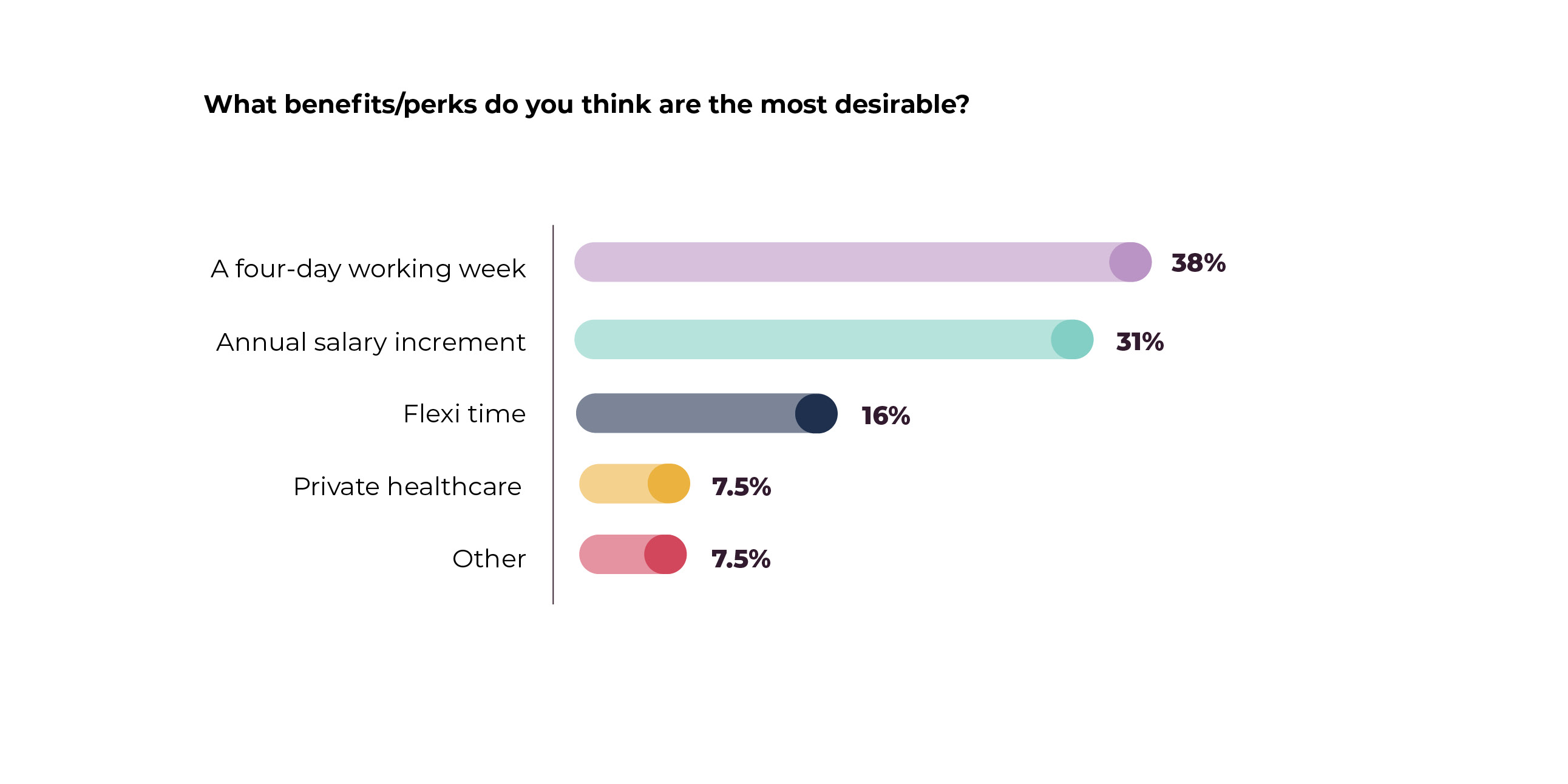

What benefits/perks do you think are the most desirable?

Key priorities for finance professionals

On the surface, finance sector professionals appear to be more satisfied with their current earnings, compared with their accountancy counterparts. 88% cite being ‘neutral’, ‘satisfied’ or ‘very satisfied’, compared to just 74% in the accountancy sector.

A Financial Manager said, “The world of finance will become more specialised as the more regular tasks become lost to technology.”

There appears to be a chasm between the financial goals of accountancy and finance professionals. 31% of finance professionals cite ‘saving for retirement’ as their leading goal, while only 10% of accountancy professionals marked this as their leading goal.

Another Financial Manager stated, “I fully support work-life balance and flexible working options including reduced hours. The work-life balance of an individual within finance is pretty poor.”

Work-life balance continues to feature heavily as a preferred perk with some finance professionals claiming that the necessity to work beyond contracted hours is damaging the balance.

Finance: male insights

The data within this section of our report details the findings from only male finance professionals.

How satisfied are you with your current earnings?

Are you confident you will achieve your financial goals in your current role?

How important is culture when looking for a job?

Key priorities for male professionals in the finance sector

For male finance professionals, an inclusive, supportive, and collaborative environment which prioritises a healthy work-life balance is key to their happiness. Our report uncovered that some male finance professionals believe that businesses have developed an expectation that professionals should work beyond contracted hours regularly.

One finance professional said, “Working with numbers and deadlines can be hectic and stressful to ensure every number is accounted for. Work-life balance is something we should strive to achieve so we can step away from the daily grind of numbers and take a breather, to rejuvenate.”

As a result, work-life balance within finance is poor as they never ‘get the time back.’ However, when asked if they would accept a lower salary for a better work-life balance, 50% of male finance professionals said they wouldn’t.

A Financial Manager said, “Work-life balance is most important. Benefits are interesting, but employers need to understand the difference between a benefit and what is barely above statutory. Then be honest and say, ‘sorry we are not in a position to offer x, y and z, however when we say our culture is…..’ it really is.”

Finance: female insights

The data within this section of the report details the findings from only female finance professionals.

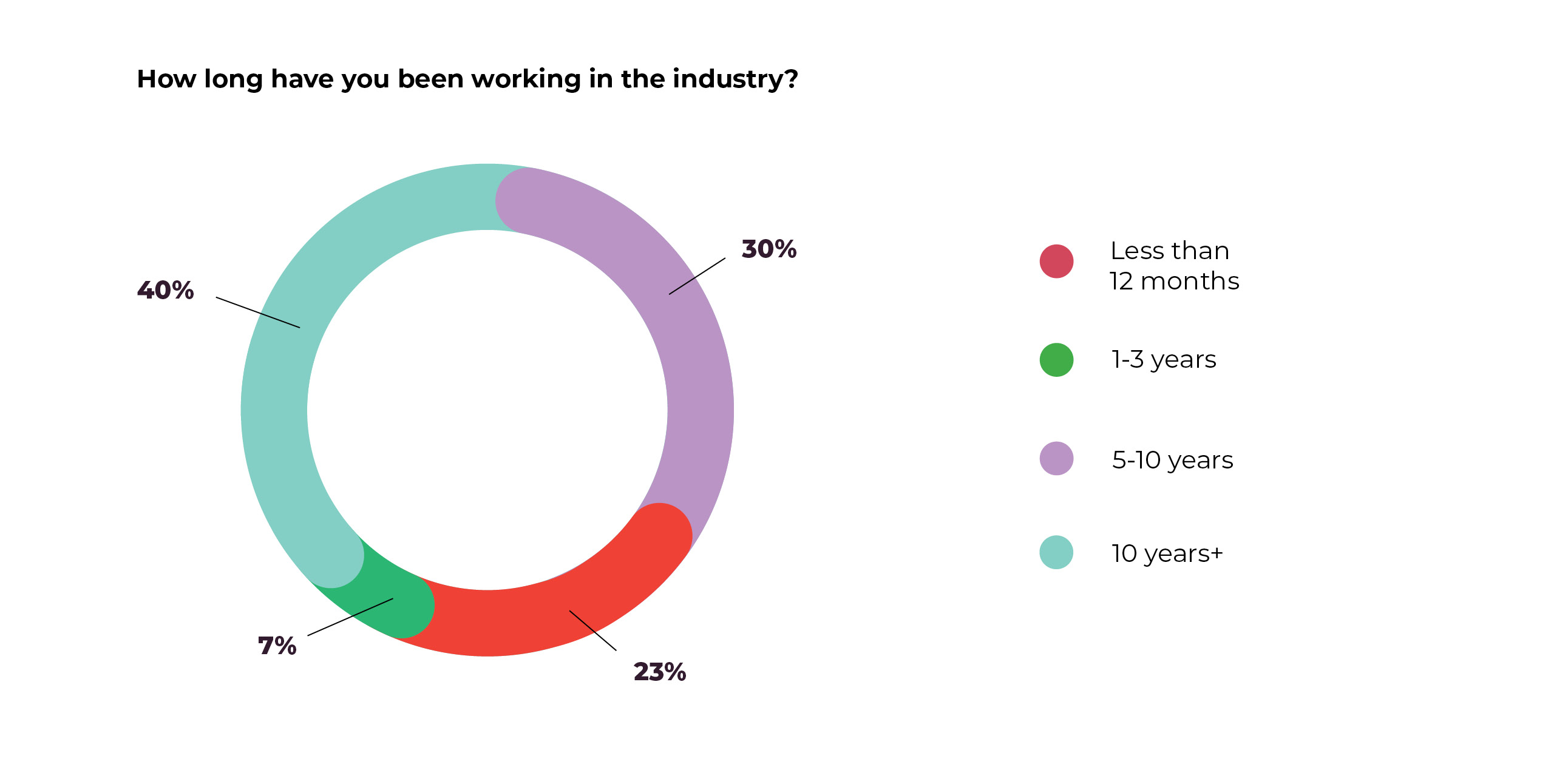

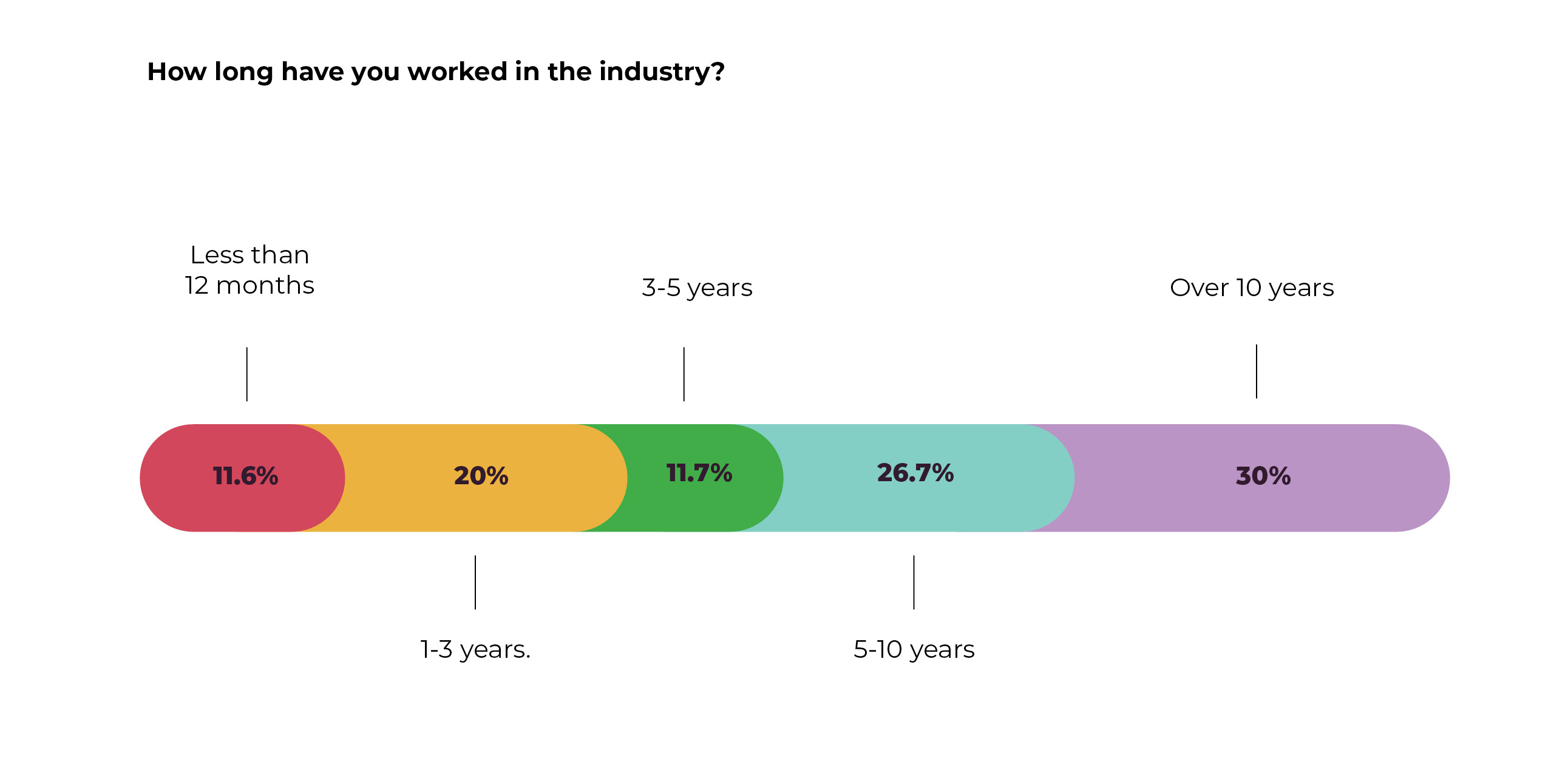

How long have you been working in the industry?

If you were to search for a new job in 2025, what would be your reason?

What are your biggest career concerns for 2025?

On what level would you agree with this statement? ‘Work-life balance is a top priority for accountancy and finance professionals today and is the most important factor after salary, followed by an appealing benefits package.’

What benefits/perks do you think are the most desirable?

Key priorities for female professionals in the finance sector

Our report highlights how women in finance seek flexibility and a better work-life balance more than ever before. A four day working week topped the most desirable perk (38%) potentially to balance the demands of their career and their desire to raise a family.

One female finance professional said, “I fully support work-life balance and flexible working options including reduced hours.”

Accountancy practices and businesses that fully embrace flexibility and work-life balance can reap the benefits in recruiting and retaining the top talent in their finance teams.

A second female finance professional said, “A business that operates its mission statement or company values, treats its employees well, has a good set of core values and operates true to those values, would be a good company to work for.”

By offering flexibility, more women can be empowered to take on leadership positions that reflect their value.

Conclusion

Due to a significant skills shortage in the sector, attracting and retaining top talent is proving increasingly difficult for employers. With needs and desires differing across sectors, genders and generations, employers must have a strong recruitment and retention strategy to cater to the needs of all employees.

Salary expectations in the accountancy and finance sector

From the findings in our report, it’s clear that one size does not ‘fit all.’

Unsurprisingly, salary reigns supreme as the leading priority for accountancy and finance professionals in 2025. With a plethora of economic challenges over the last few years, many professionals are ‘feeling the pinch’ and feel concerned about the decline in living standards from what they have previously enjoyed.

For employers who are able to do so, keeping salaries competitive is a strong recruitment and retention strategy which should be adopted. In scenarios where it isn’t financially possible to offer higher salaries, there are other levers which employers can pull to ensure job satisfaction.

For example, a four day working week is highly attractive to many professionals to achieve a better work-life balance. Similarly, remote working is also extremely advantageous and enables the employee to make cost savings on commuting.

Career development opportunities for accountancy and finance professionals

Investing in Continued Professional Development is crucial for many reasons including maintaining professional competence, improving the quality of work and meeting regulatory requirements.

Employers who provide opportunities, time and resources to upskill their employees are highly desirable as it signals that they are investing in the employee for the long term. This gives employees a greater sense of value and job security, and opportunities to advance their accounting career.

The demand for better work-life balance in the accountancy and finance sector

Work flexibility is highly favoured by employees who want to achieve a better work-life balance. The ability to work flexibly or remotely allows individuals to better balance their personal and professional responsibilities. Particularly if the individual is juggling parenthood or caring for elders, a good work-life balance enables the individual to have some time for themself and avoid burnout.

Employers who address these concerns and offer flexible working will reap the benefits through a motivated and satisfied workforce in 2025.

Methodology

The data within our report was collected via an online survey created by Spencer Clarke Group, published through Google Forms.

The online survey was distributed to accountancy and finance professionals across the UK, via email and LinkedIn. The survey was answered by sixty professionals of varying experience and those working in industry and in practice. This included professionals ranging from Junior and Transactional, to Senior, Managing Partner and Director level.

The main objective of our report is to determine what accountancy and finance professionals are looking for in a job in 2025. Our report explores beliefs and perceptions surrounding preferred salary, perks, benefits, work flexibility and culture, as well as reasons they may consider searching for a new job.

Both the qualitative and quantitative research method was used to collect information. Quantitative data was used to identify patterns, understand opinions and attitudes, and draw conclusions. Qualitative data was used to generate new hypotheses, trends and anomalies.

Detailed responses provided unique insight, highlighted different problems and shone a light on new opportunities. The qualitative data method also helped to uncover societal trends, provide enhanced depth and give meaning to individual answers.

Do you work in accountancy (in practice) or finance (in industry)?

To better understand our respondents, we first identified whether they worked in the accountancy or finance sector. The graph below illustrates the breakdown of our survey participants, ensuring that our insights are relevant to professionals within these industries.

How long have you worked in the industry?

We also explored their level of experience in the industry, including their years of service and current job level (e.g. junior, senior, management). The graph below provides an overview of these key demographics, helping to contextualise our findings within different career stages.

Accountancy jobs

If you’re searching for your next accountancy job, why not take a look at the latest vacancies, or simply upload your CV to be notified when a relevant position becomes available.

Accountancy recruitment services

As specialist accountancy recruiters, we support practices nationwide with their permanent recruitment needs.

Whether you’re searching for a tax, audit or payroll specialist, we will help you to find whoever you need to make your practice thrive.

If you’re struggling to fill a vacancy, why not get in touch with Management Consultant Lauren Bailey on 01772 954200 to see how we can help?

Finance jobs

If you’re searching for your next finance job, why not take a look at the latest vacancies, or simply upload your CV to be notified when a relevant position becomes available.

Finance recruitment services

As specialist finance recruiters, we support businesses nationwide with their permanent recruitment needs.

Whether you’re searching for a Financial Controller, Management Accountant or Head of Finance, we will help you to find whoever you need to make your business and finances thrive.

If you’re struggling to fill a vacancy, why not get in touch with Managing Consultant, Shannon McGarry on 01772 954200 to see how we can help?

Who is Spencer Clarke Group?

Established in 2017, we’re an award winning and progressive recruitment agency based in the heart of the North West. Our reputation is built on trust, expertise and an unwavering commitment to exceed expectations.

In 2024, we were named Recruitment Agency of the Year at the prestigious Recruiter Awards, an accolade we are extremely proud of.

We operate in two sectors:

In eleven specialisms:

Healthcare, Social Care & Nursing

Corporate Functions & Business Support